Over the last few years, the insurance industry has been undergoing a digital transformation thanks to the adoption of consumer technology. The proliferation of mobile phones in every customer’s pocket, digital-first applications appearing in many institutional organs like banking and government, and easier online-only services have led customers to no longer tolerate digital-first approaches, but demand them.

It’s a convenience of opportunity for both businesses and customers, and the insurance industry is in the throes of catching up to customers’ digital needs.

Predictive analysis, artificial intelligence, and machine learning are some of the key ways which have led to a vast digital transformation

This has been an extremely critical move to keep up with the customers’ demands. In the hyper-competitive insurance industry, any business that wants to stay afloat has to constantly think about innovating the customer experience.

Even though customers across industry verticals continue to view the experience offered to be just as important as the product or service sold by a business, there is often a mismatch between what’s expected and what’s delivered.

As a leader in digitalizing the experience and products that insurers deliver, we at CoverGo are here to help you identify what the customers expect and how insurers can take the customer service experience to the next level by adopting a digital-first experience.

What are the customers looking for and how can you improve their experience?

Insurance is no longer merely a financial instrument that people want to buy. Modern-day customers want insurance to be something more than only providing a cushion in times of need — they are looking for a more personalized digital experience to maintain their loyalty. Here’s a look at the key trends that have emerged until now:

Omnichannel customer servicing

It is no longer enough for insurers to strive to deliver excellent customer service. In fact, simply being online is not even enough. They need to engage and continue engaging customers through their preferred channels of the customers, such as email, messenger apps, chatbots, etc. In industry parlance, this is called omnichannel customer servicing, or simply omni-channel distribution. Delivering such an experience throughout the customer journey seamlessly can make an insurer stand out from its competition.

A report suggests that over 50% of insurance customers use three or more channels when researching new policies to purchase. Each channel offers unique benefits to them, making omnichannel customer engagement a go-to option. Moreover, after purchasing a new policy, customers prefer omnichannel engagement, such as using the chatbot on the insurer’s website to clarify any queries, using smart wizards to set up new purchases, managing current policies, and more.

For current clients, customer engagement is a passive strategy to keeping those customers by not just engaging them on the channels they prefer, but putting the control of their account in the palm of their hands. Quite literally, mobile apps are a mainstay of human interaction with their day-to-day needs.

While traditionally, the insurance business was centered around selling different products through a network of agents, there is a pressing need for insurers to establish a direct line of communication with clients. That’s why insurers want to develop different channels to interact with them. But a key challenge faced while building newer distribution channels is integrating the channels into the native system of insurers. At CoverGo, our front-end enabler makes it easy to develop flexible and responsive front-end websites without using a single line of code that can be completely integrated into any third-party system.

We’re not saying that the days of the insurance agent are over either. Agents are highly skilled and knowledgable professionals who can translate the wacky world of insurance jargon into easily digestible products and boil down paperwork to something less intimidating to clients.

The nature of insurance agents in a world of digital-first experiences can be bridged by simply allowing for a medium where agents can engage clients through those very same channels they prefer. It just might so happen that the nature of their work might be less head-hunting and meeting clients with paperwork, and change into something of a hybrid between being an agent and also helping with current client engagement, almost like a point of first contact for anything just shy of customer support.

Having access to lifestyle apps

To find out the appropriate health insurance product a customer should get, they need to get a series of medical check-ups done. This involves a visit to medical professionals. Often, it deters the customer from getting the right insurance product, especially if something should come up unexpectedly, and thusly impact their ability to get insurance products beneficial to them.

Lifestyle apps can make a huge impact in this segment. These apps can track a range of health and fitness metrics of customers, making it easier for insurers to offer customized policies. After all, clinical data such as heart rate, weight, height, blood pressure, etc., do not present a comprehensive picture of one’s health in the absence of finer details of lifestyle. Such apps make it convenient for customers to find the right product based on their unique risk factors and also help insurers to underwrite the risk by weighing in the distinct lifestyle factors for each policyholder.

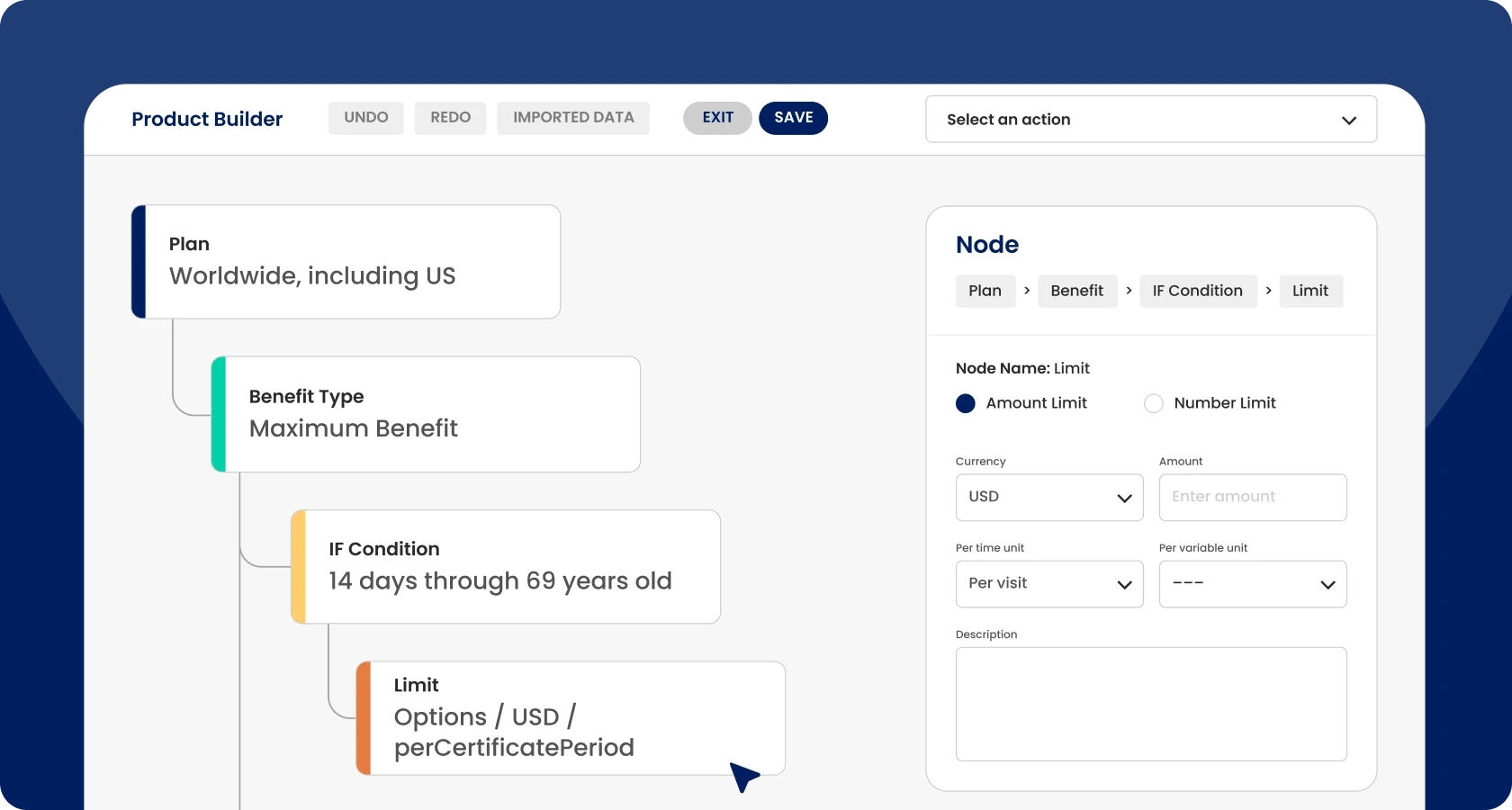

On CoverGo, you can create and configure new insurance products on our Product Builder platform without any code. These products can be fully integrated into your system. The key here is an insurer can quickly adjust products to match client profiles that thanks to lifestyle app datasets, show there are more varied and niche risk factors among many different lifestyles.

Better risk management services

Risk management in insurance involves assessing and quantifying the loss that the insurer needs to settle. Digitizing risk management benefits both customers and insurers. For customers, it improves the quality of the overall service once a claim is raised. For instance, if customers have access to a mobile app that monitors the location of the insured item, necessary data related to the loss can be shared directly with the insurance company at the time of raising the claim. For insurers, digitized risk management promotes efficiency in managing risks and identifying unknown ones.

What are the key challenges to delivering superior customer experience?

The massive amount of data makes the insurance customer lifecycle complicated. One of the crucial challenges faced by insurers is delivering the right product based on the needs of their customers. An easy fix is to identify who is the target audience, develop a buyer’s persona, identify their specific needs, and then place the product as a solution. Adopting a targeted sales approach based on how likely the customer is to purchase a new product and whether the product eases the customer’s current concerns can make the purchase process more efficient.

Secondly, how customers look at insurance has changed massively. It is no longer about filling out a form and paying premiums yearly. Customers want to have access to policies and insurance resources 24/7 in a manner they can easily comprehend. Here’s where apps and websites become extremely important.

There is a greater need for insurers to develop self-service portals that takes care of common concerns such as signing up for a new policy, renewing a policy, raising and settling a claim, reviving lapsed policies, etc., without any external help. Simplifying the process can go a long way in improving customer experience and making insurance more enjoyable.

Not providing personalized insurance offerings can impede customer experience by bridging down both customer acquisition and retention. Being where your customers are and developing omnichannel customer support tools can help offer a more personalized and consistent experience.

Lastly, a lack of transparency in the claims process can be a deal-breaker for customers. Customers feel more empowered to raise claims when they are armed with relevant information. CoverGo offers an easy-to-implement policy admin system that allows insurers to manage the entire customer journey, including the claims process, from a single portal. Not only is it modern and efficient, but it also helps insurers save time by automating critical processes. Moreover, it can also prevent unnecessary delays in raising and settling claims, leading to a better customer experience.

Is your company on the right path when it comes to customer experience?

If insurers are keen to move beyond a transactional relationship with their customers, emphasizing improving customer experience has to be the starting point. And adopting artificial intelligence throughout the lifecycle of a customer’s journey can go a long way in enhancing customer satisfaction. When customers feel known, served with the appropriate policy offers, raise claims seamlessly and receive payouts, instant policy refunds, or claim payouts, they are likely to have a better experience.

Set up a demo with CoverGo to understand how we can help you step up your insurance business to design products and services centered around excellent customer experience. And without using any code.