Technology has irreversibly changed how the world functions as reduced human intervention and increased digitization are the new norms. Any business serious about making a mark in this hyper-competitive market must embrace it to keep up with consumer expectations.

The insurance industry is no exception to the above. In fact, despite being heavily reliant on manual processes, going digital can help insurers become more swift, efficient, and accessible to their customers.

Here’s everything you need to know about digitally transforming your insurance company.

What is Insurance Digital Transformation?

Digital transformation of any business refers to the adoption of technology for creating new processes or modifying existing ones to cater to changing customer needs and expectations.

In the context of the insurance sector, digital transformation includes adopting digital strategies for managing various aspects of the insurance business for a more swift turnaround and better customer service.

It enables insurers to rely on the Internet of Things, big data, cloud-based services, predictive analytics, and even AI to handle a major chunk of the work — from preparing quotes for policies and receiving payments to processing claims.

Why is digital transformation important for insurance companies?

Digitizing the critical components of an insurance business that generate maximum value, such as product building, customer service, payments, claims, and the sales and distribution of various insurance products, all come together to benefit insurers in various ways.

Some of the key advantages include:

Increasing efficiency

The key advantage of leveraging digital technology is speeding up operations, and one of those operations that oftentimes brings efficiency to a screeching halt is product building.

For insurance companies to thrive in the market and meet client needs quickly, the speed it takes to get to market is key for insurers who want to stay ahead of the pack. Without proper digitization in place, in a world where customers are demanding more digitization in their experience, no insurance company can truly hope to grow in this day and age.

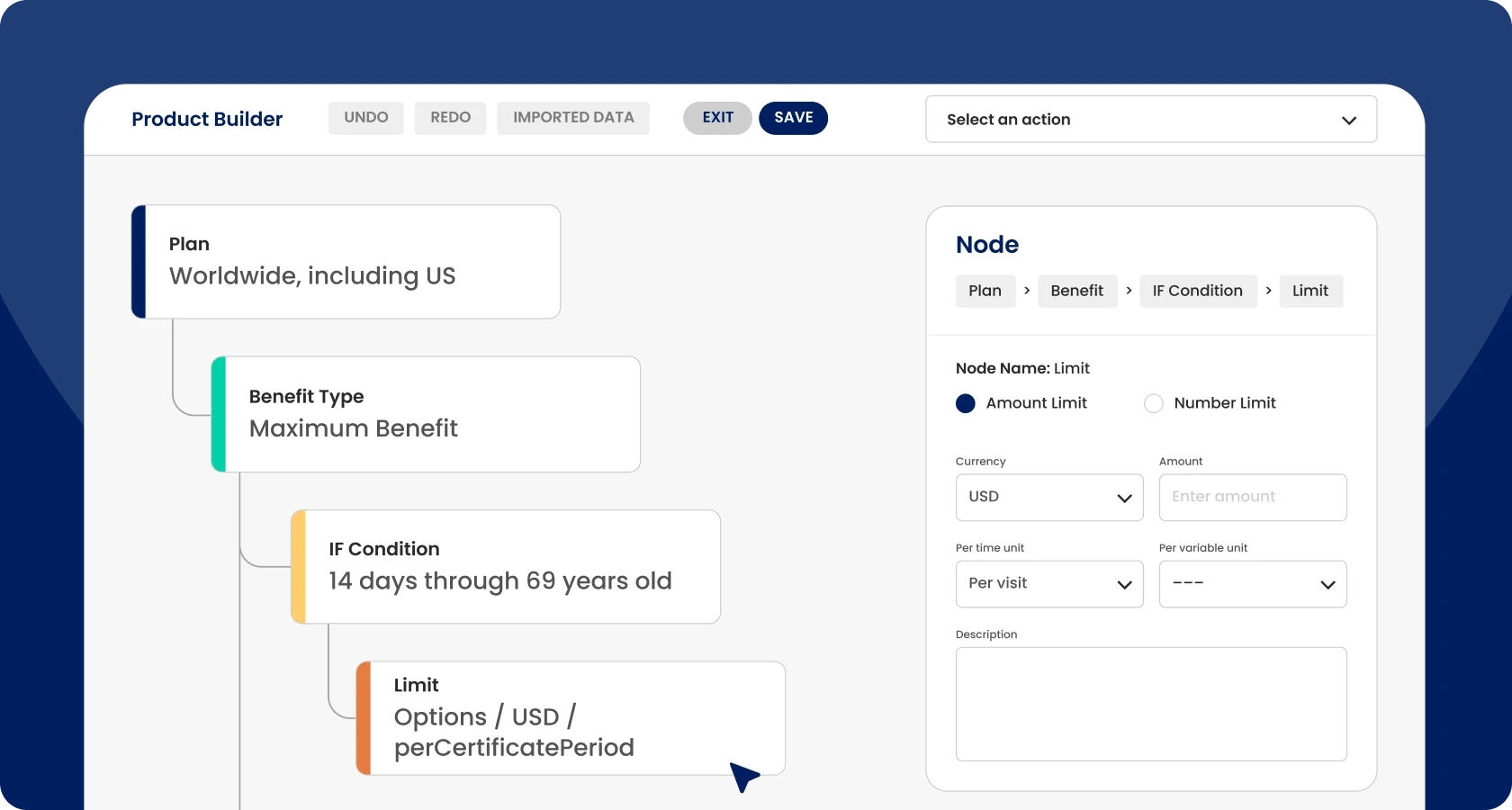

Digitizing the experience and using tools like CoverGo’s no-code product builder can often flip the script for insurers and turn product building from a 6-month endeavor into a 6-hour crunch. The rate at which an insurance company can build products and then launch them to the market is one of the biggest deciding factors for becoming an insurance market leader today.

And once a product is finally out in the wild, then comes the efficiency question for handling claims, policy admin, agency management, and other background processes that insurers need to handle perpetually. Digital transformations help to automate or streamline processes so that they’re painless to handle.

For instance, instead of having a claims handler manually enter data online into the insurer’s system, an insurance company can set up automated processes to feed the data instantly. This not only improves the accuracy of claims but also results in higher customer satisfaction by minimizing touchpoints for claim management.

Similarly, insurance companies can harness digital technology to cut down on unnecessary paperwork and get their customers to complete all aspects of policy management remotely using digital tools.

Additionally, digital transformation can enable insurers to configure, price, and underwrite various insurance products at a quicker pace. Using predictive analytics, an insurer can find out whether certain vehicles are more likely to meet with an accident during specific weather conditions and decide the premium of the vehicle insurance policy accordingly.

Delivering personalized services

Digital transformation helps insurers deliver a seamless personalized experience to all the stakeholders by automating various aspects of policy administration and claims management. This means no more unnecessary delays for customers who may be left wondering if their claims process has been started.

Hassle-free processes and ease of access can boost customer satisfaction, resulting in higher revenues.

Enhancing innovation and agility

Insurance companies can use evergreen digital transformation tools to future-proof their business and become empowered to look for more advanced solutions for their customers in the time to come.

Having said that, insurers are also free to undertake digital transformation at their own pace. They can choose one line of business and implement new technology to examine what it is really capable of achieving.

Supporting omni-channel distribution

Insurance companies are facing new challenges due to the growing number of channels through which customers interact with them. The rise of mobile apps has led to a shift from desktop to mobile devices, from agents over the phone to chat messaging, etc. In addition, social media platforms such as Facebook and Twitter have become important touchpoints for consumers as well. These changes have created new opportunities for insurers to reach their target audiences.

Modern-day customers prefer researching and making purchase decisions about insurance products via omni-channel applications. Digital transformation allows insurance companies to create white-label omni-channel applications to engage customers online and offline with limited human interaction. This can be client portals, microsites for instant quotes, comparison, e-application, online claims handling, and more.

The trick is, how does an insurer tackle these changing consumer needs on so many channels? Quite typically, this comes down to digital distribution being handled by software like CoverGo that is tailor-made to combine all these channels and make it so products and policies can be delivered seamlessly, open new channels for insurance companies, and drive clients through digital onboarding that works.

Enabling Digital Embedded Insurance

Say you go to buy a car. The sale is made and the inevitable question of insurance comes up. This is the principle of embedded insurance, the offering of insurance coverage at the exact time the sale of a product that concerns the customer comes to fruition, and when it matters the most.

Digital embedded insurance is the same principle applied to digital channels. Have you ever booked a flight and at the checkout screen before you pay for your flight, you’re offered an option to add on Travel Insurance?

Insurers are often looking for options to digitally deploy embedded insurance, with the key component being that products are delivered personalized, and scalably. These days, enabling digital embedded insurance comes from the act of using software to deliver products to customers online where it makes sense.

Offers for insurance coverage online need to be seamlessly deployed to hundreds or even thousands of instances of purchases and deal-making online, whether it’s embedded in a check-out page of an e-commerce giant, an airline’s booking system, and more. Only a true digital transformation can both personalize this experience and deliver it at scale for every customer use case.

Engaging in Affinity Partnerships

Affinity Partnerships are the backbone of embedded insurance.

Enabling embedded insurance is one thing, but if you lack the networks to deploy your embedded products on, it’s not going to get your business very far. Affinity partnerships are not a new thing in the insurance world, but the rise of digital-first purchases has made it so that affinity partners will often demand that insurers keep up.

Imagine you hit the jackpot and you become the sole travel insurance provider for a huge flagship airline. If you were transformed into a digital-oriented insurance provider, this would be a cakewalk, embedding your coverage into their traveler’s booking experience, increasing everyone’s value.

But if you skimped on digital leg-day, you’ll be found wanting in the eyes of potentially fantastic affinity partners, and even your less preferable competitors will scoop up the opportunity simply because they can digitally deploy quickly, and you couldn’t.

In the end, your affinity partnership success depends on whether or not your company can meet its customer’s demand for digital-first experiences.

What’s the process of digitally transforming your insurance company?

Digital transformation can’t just happen overnight. But it doesn’t have to take long either.

Depending on the systems and how legacy they are in current insurance systems, quick wins are still possible in a matter of hours or as much as a few days. One thing is certain though, and that is it’s entirely realistic to transform from a traditional insurance company into a digital one in a short amount of time.

Some insurers are scared to dive into digital transformation, thinking it would take too long to upgrade their customer-facing processes, and oftentimes focusing on the internal processes for digitalization. While internal processes do stand to benefit from a digital upgrade, none of these improvements can truly be felt by their customers, and this is where the biggest impact of digital transformation lies.

Digitizing is a 360 degree transformation, impacting primarily the processes that concern customers and their experience. With software platforms out there like CoverGo, insurers are achieving quick wins by using out-of-the-box, no-code methods of transforming their business processes both internally and client-facing.

A super-rough roadmap for the digital transformation of an insurance company consists of the following stages:

Stage 1: Automating existing processes

Automating current processes is key to starting the insurance digital transformation journey. Without automation, it is nearly impossible to anticipate various customer demands, reduce waiting times, and deliver a personalized experience.

Here are some aspects of an insurance business that can benefit from automation:

- Billing and communication

- Underwriting

- Policy management and administration

- Answering customer queries in real-time

- Fraud detection

- Marketing new insurance products

Stage 2: Optimizing key business elements

After automating specific processes, an insurance company should identify the key elements of its business that differentiates it from the rest and optimize them through digital technologies.

For example, some insurance companies may adopt digital transformation to create newer products to serve specific needs in the market. Others may employ digital transformation to deliver their offering faster than their competition or simply become a company providing seamless customer service.

Stage 3: Undertaking complete digital transformation

The ultimate stage is opting for an end-to-end digital transformation of the insurance business by keeping the customer’s expectations at the front and center of every decision-making.

For true digital transformation, insurers need to understand the changing dynamics between various market participants and facilitate real-time communication between their various internal and external business units.

Are you ready to transform your insurance business digitally?

Undoubtedly, the wins from digitally transforming your insurance company can be huge. It can help reduce unnecessary costs across the insurance value chain and boost the customer’s lifetime value.

But before diving straight into it, here’s what you need to ask:

- What business goals do you want to achieve?

- What is the business’s KPI for the next 1,3,5 years?

- Have you identified what the customers want?

- Are your employees prepared for the digital shift?

- Do you need to hire someone for digital transformation or do you plan to do it in-house?

- Do you have adequate resources?

It’s only after assessing your business goals and KPIs can you truly move forward with a digital transformation. It’s only once you identify your goals that you can start to also identify your must-haves in your organization, systems, and processes.

Ancillary items like resources, support, etc, can all be solved after the fact. Worrying about the how long before the why will often distract insurers from realizing that digital transformation was always about getting them to reach their business goals, and not their technical goals.

It’s key to focus on the goals that bring your business to a higher level, and that’s where platforms like CoverGo often deliver quick wins to mission-focused insurers.

So how do you know if you’re ready for digital transformation?

Contact one of our experts at CoverGo and we’ll help you find out.

Digital transformation is the future

Insurance companies have immense pressure to keep up with the ever-changing customer demands and innovations in the industry. Given the low-entry barriers, the possibility of newer players coming in and offering products at a faster pace and cheaper rate cannot ever be ruled out. To stay relevant and ahead of the competition, companies need to adapt to the changing digital era and have a long-term plan for technological innovation.

At CoverGo, we offer cutting-edge technology to insurance companies to help them serve their customers better. CoverGo is a pioneer in the insurance industry that provides a fully configurable, modular, enterprise-grade, no-code SaaS insurance platform, supporting omni-channel distribution, policy admin, and claims. Get in touch right away to schedule a demo.