Reimagine your operations with AI agents.

An AI Agent is a packaged solution for a specific insurance task - such as underwriting, claims processing, customer support, or sales.

Serve customers faster than ever. Powered by intelligent, insurance-specific AI Agents - including Intelligent Document Processing (IDP) AI Agent - CoverGo automates workflows across distribution, policy servicing, and claims. We empower insurers, MGAs, and brokers to modernize and move at the speed of change through end-to-end digital transformation.

An AI Agent is a packaged solution for a specific insurance task - such as underwriting, claims processing, customer support, or sales.

The backbone of operational efficiency. This universal agent automates data extraction from any unstructured document (e.g., claims forms, medical reports, applications) and transforms it into structured, usable data. It can be applied across the entire insurance value chain to eliminate manual entry and slash processing times.

An expert-in-a-box for your teams. This agent ingests all of a company’s internal knowledge like product brochures, policy wordings, underwriting guidelines and provides instant, accurate answers via a simple chat interface. It empowers customer support teams to resolve queries in seconds and enables sales teams to find the right information on the spot.

The new engine of seamless distribution. This intelligent agent automates the generation and comparison of insurance quotations by interpreting customer requests and navigating insurer portals. This solution enhances efficiency, reduces manual efforts, and ensures customers receive a comprehensive comparison of available insurance products.

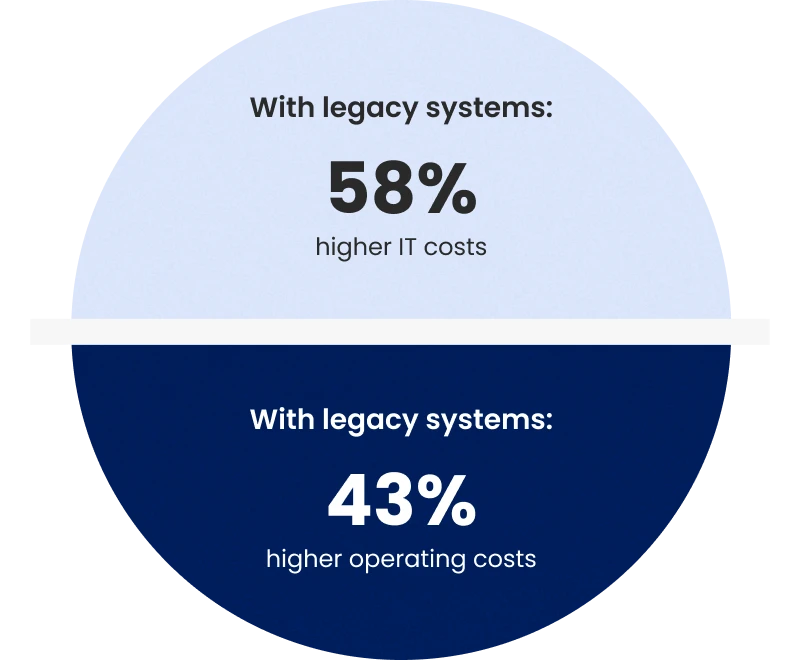

As an insurance professional, you understand that going digital is essential; however, you face significant legacy system costs and roadblocks in adapting to the changing market and customer needs. This results in legacy systems’ IT costs being 58% higher and operating costs 43% higher compared to modern systems (McKinsey).

CoverGo is here as your true technology partner providing a flexible, future-proof core platform to fulfill your digital transformation needs and business goals across the entire insurance value chain — from fast product building, omni-channel distribution to digital policy admin and claims.

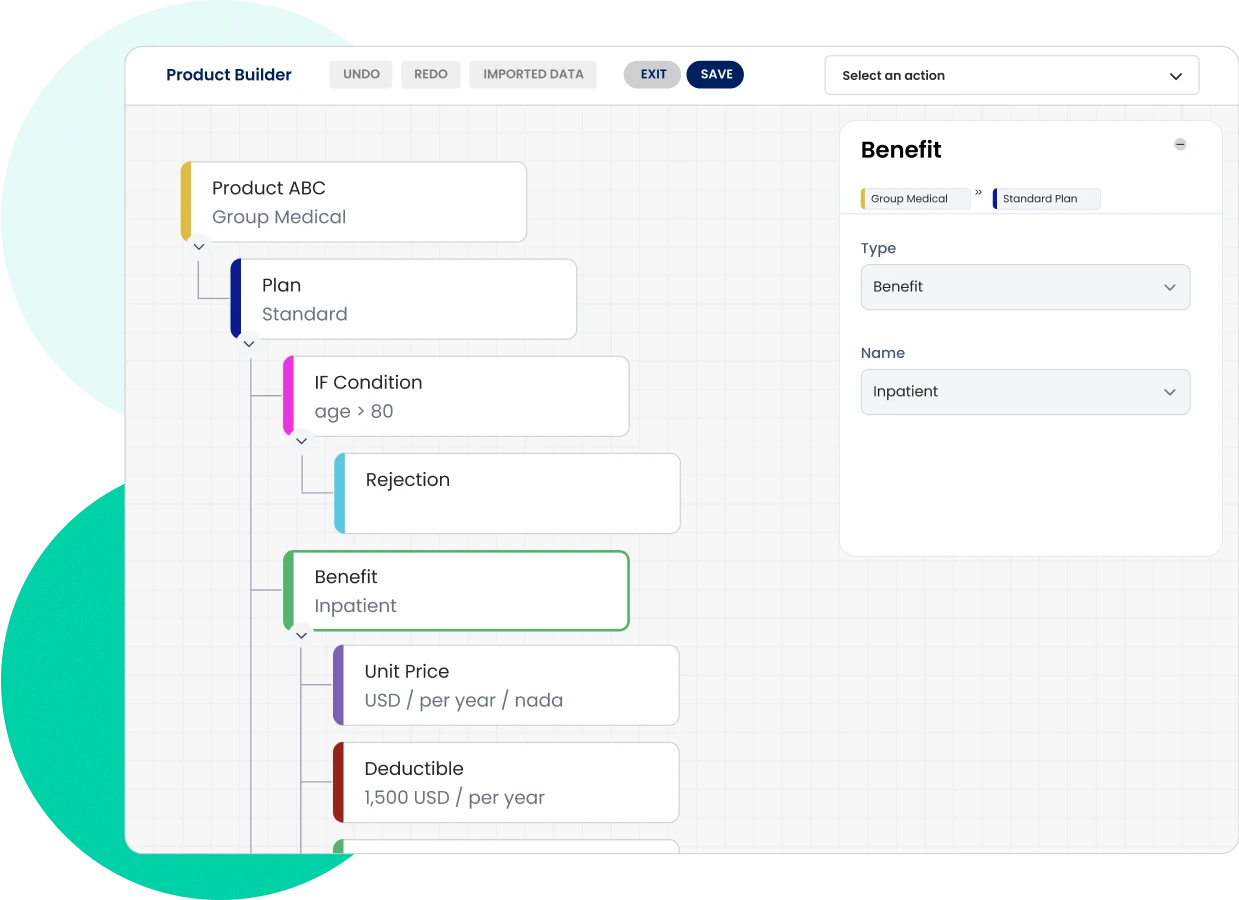

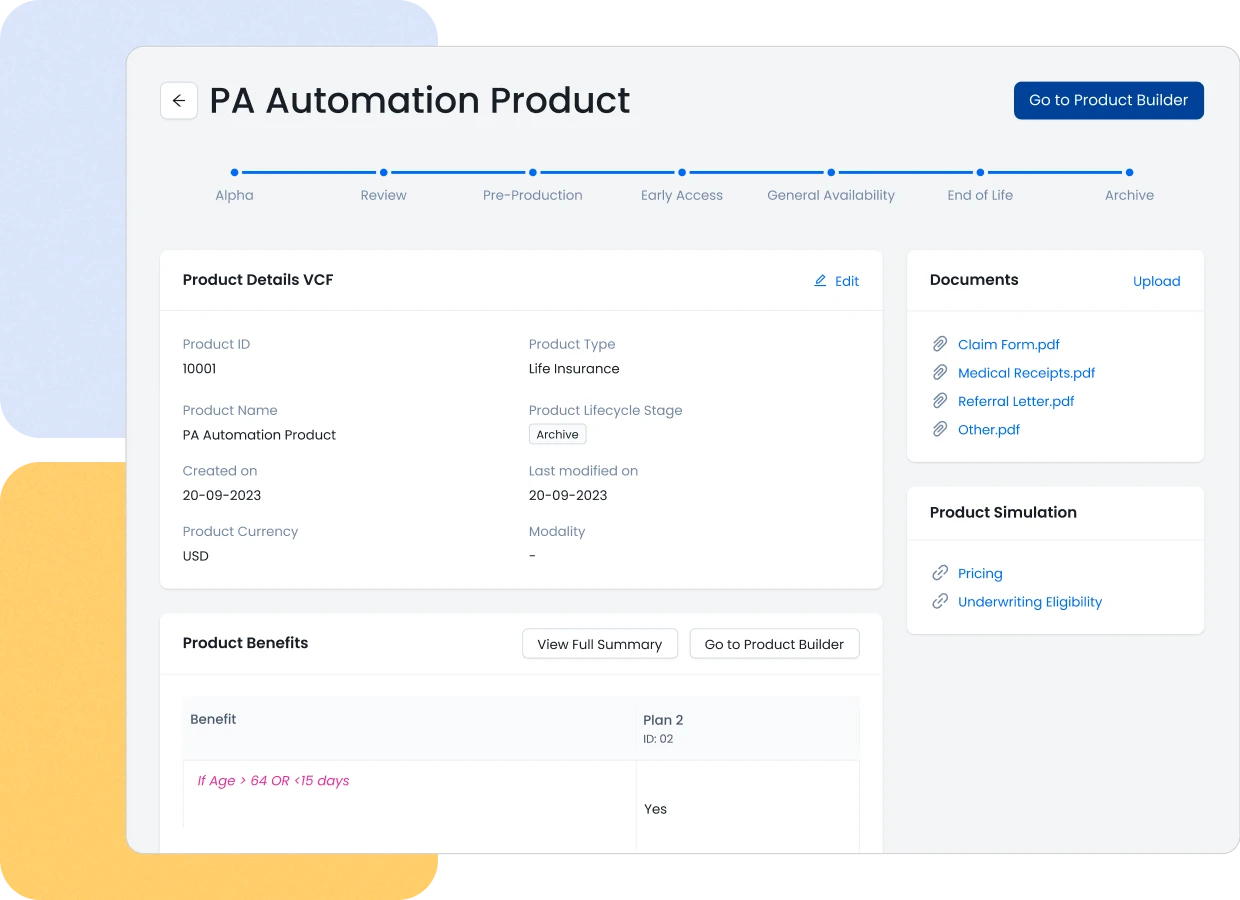

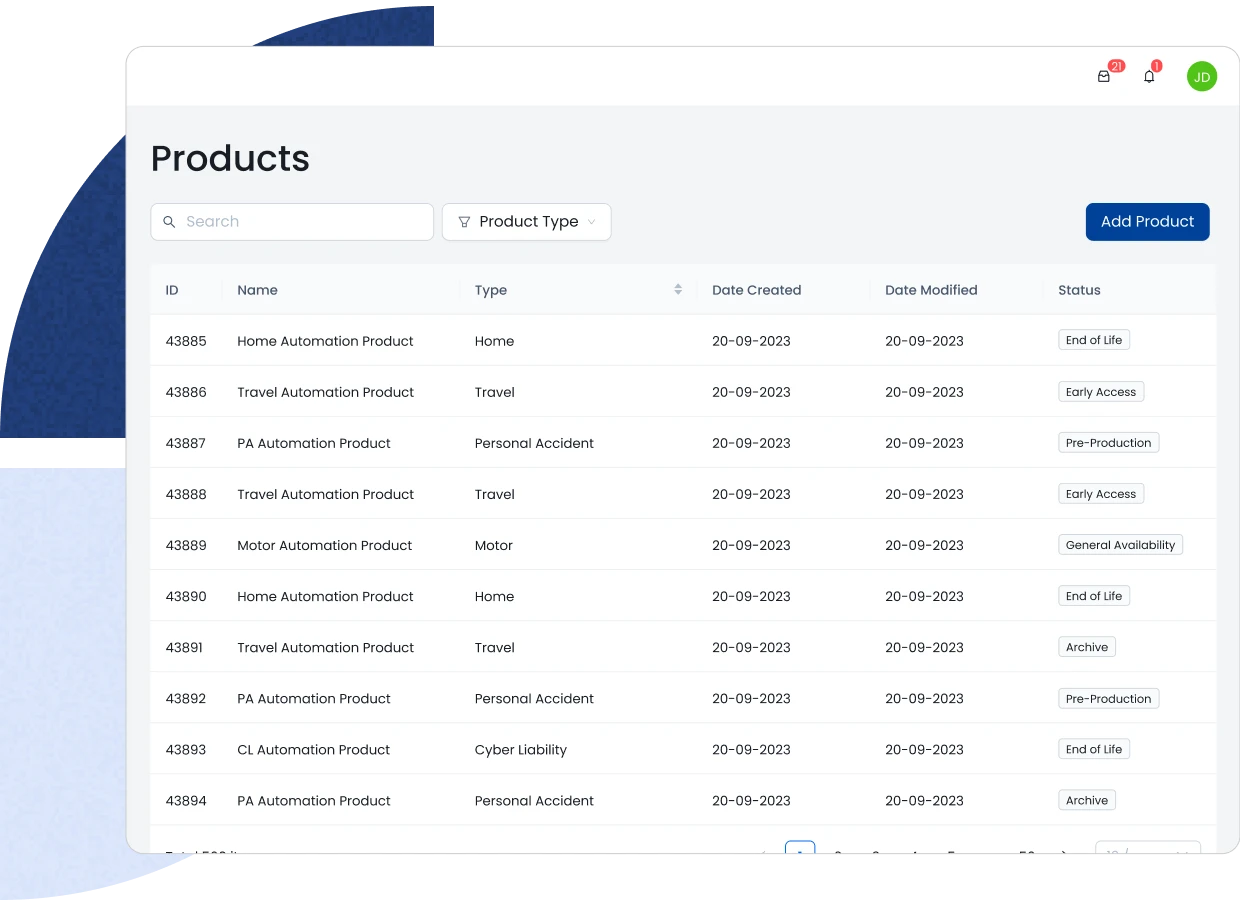

Build insurance products your customers want in a few days instead of months and without a single line of code with our patented drag-and-drop, no-code product builder, saving over 90% of product building time and cost.

With our next-gen, no-code, AI-powered insurance platform for omnichannel distribution, grow your business by reaching new and existing customers across any channel – from direct, agent and broker distribution, to bancassurance, embedded insurance and affinity partnership channels – and enable a digital insurance ecosystem.

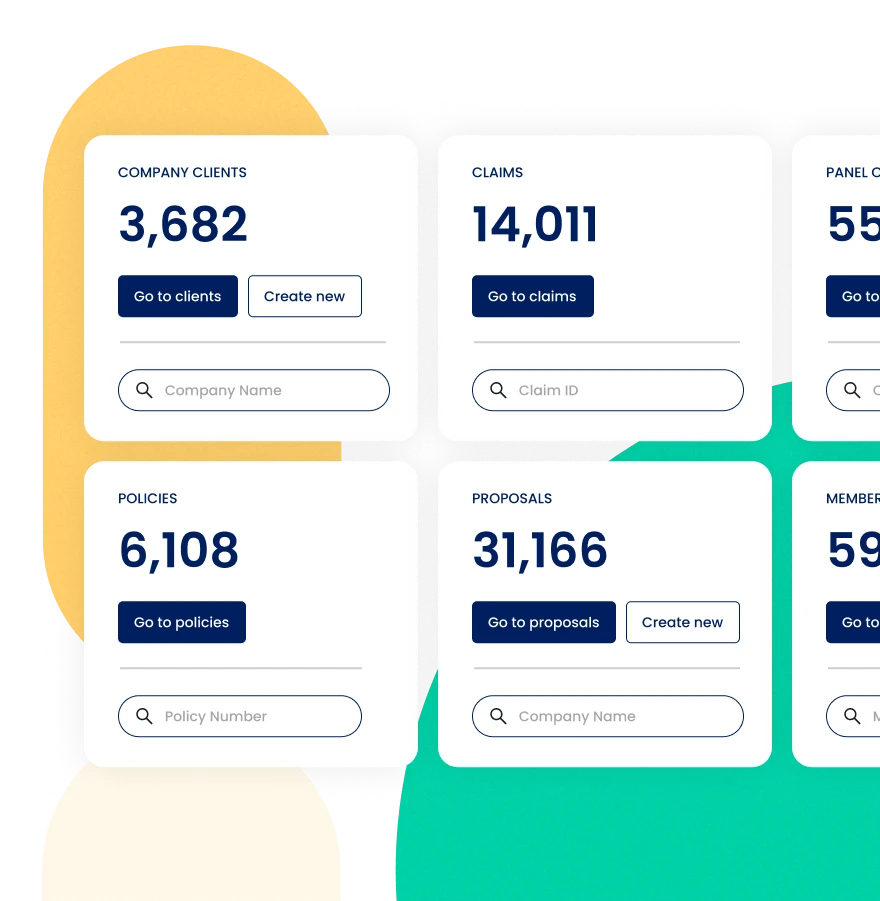

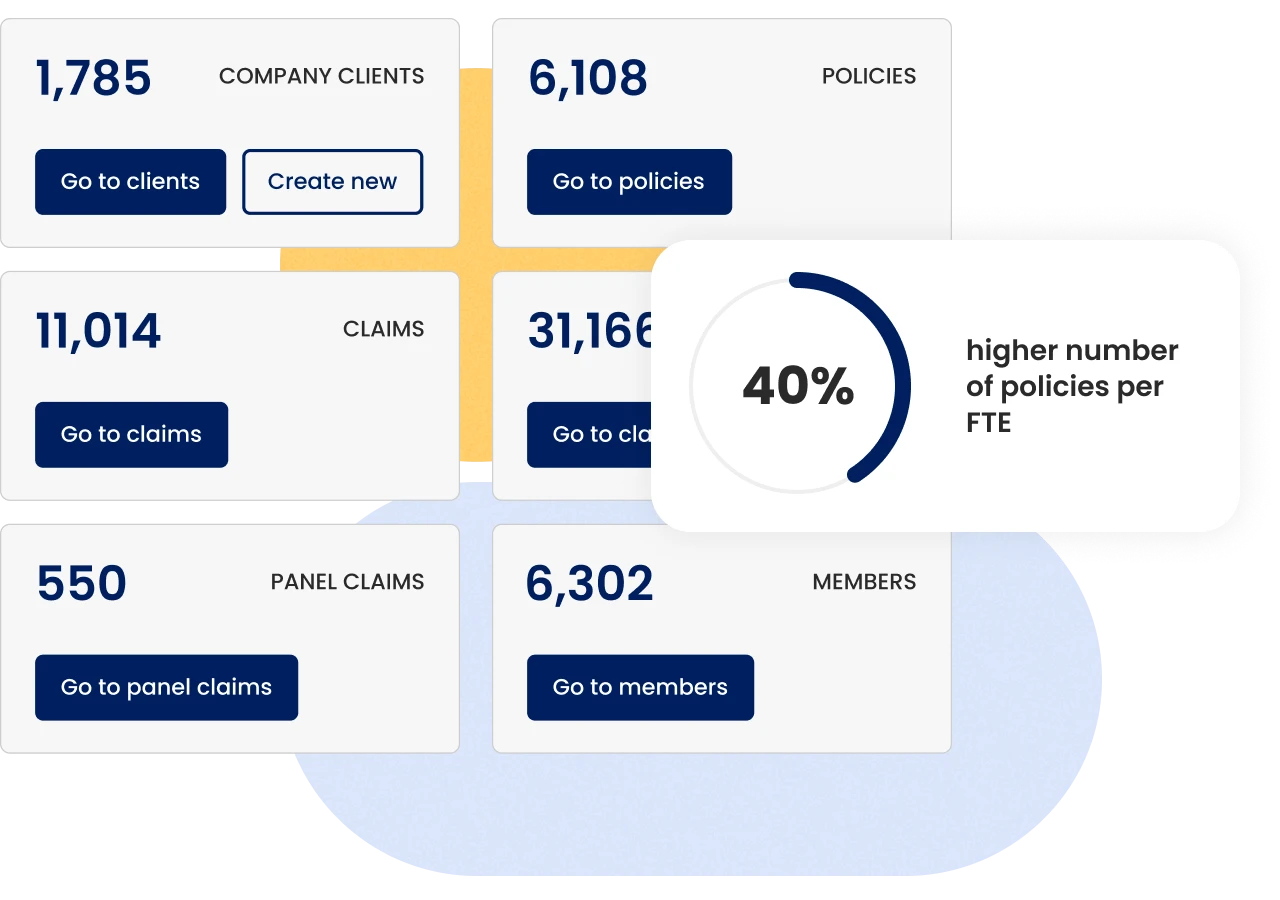

Manage your policies, renewals, endorsements, clients, and other processes in a digital way, enabling major cost savings and improved efficiency and productivity through seamless processing.

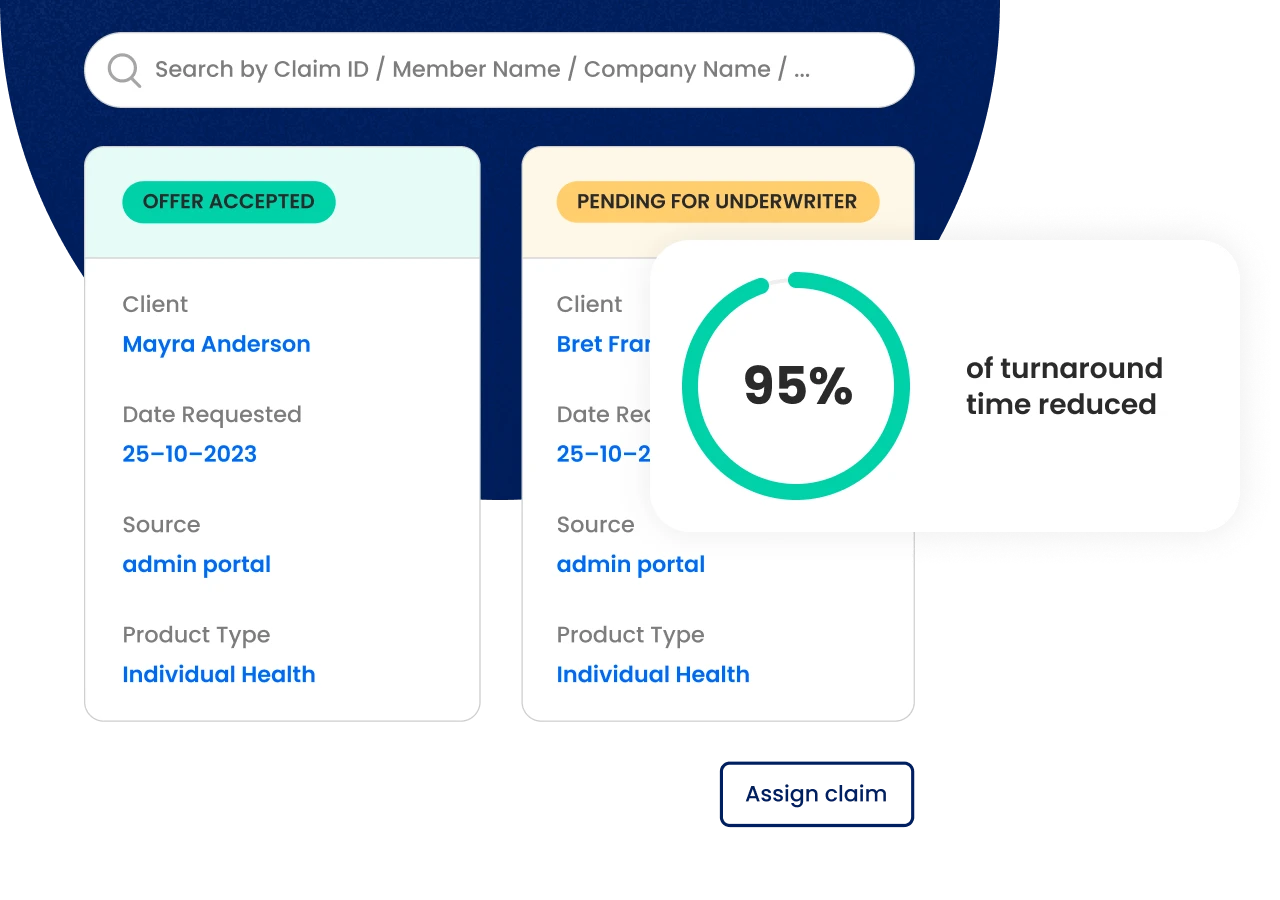

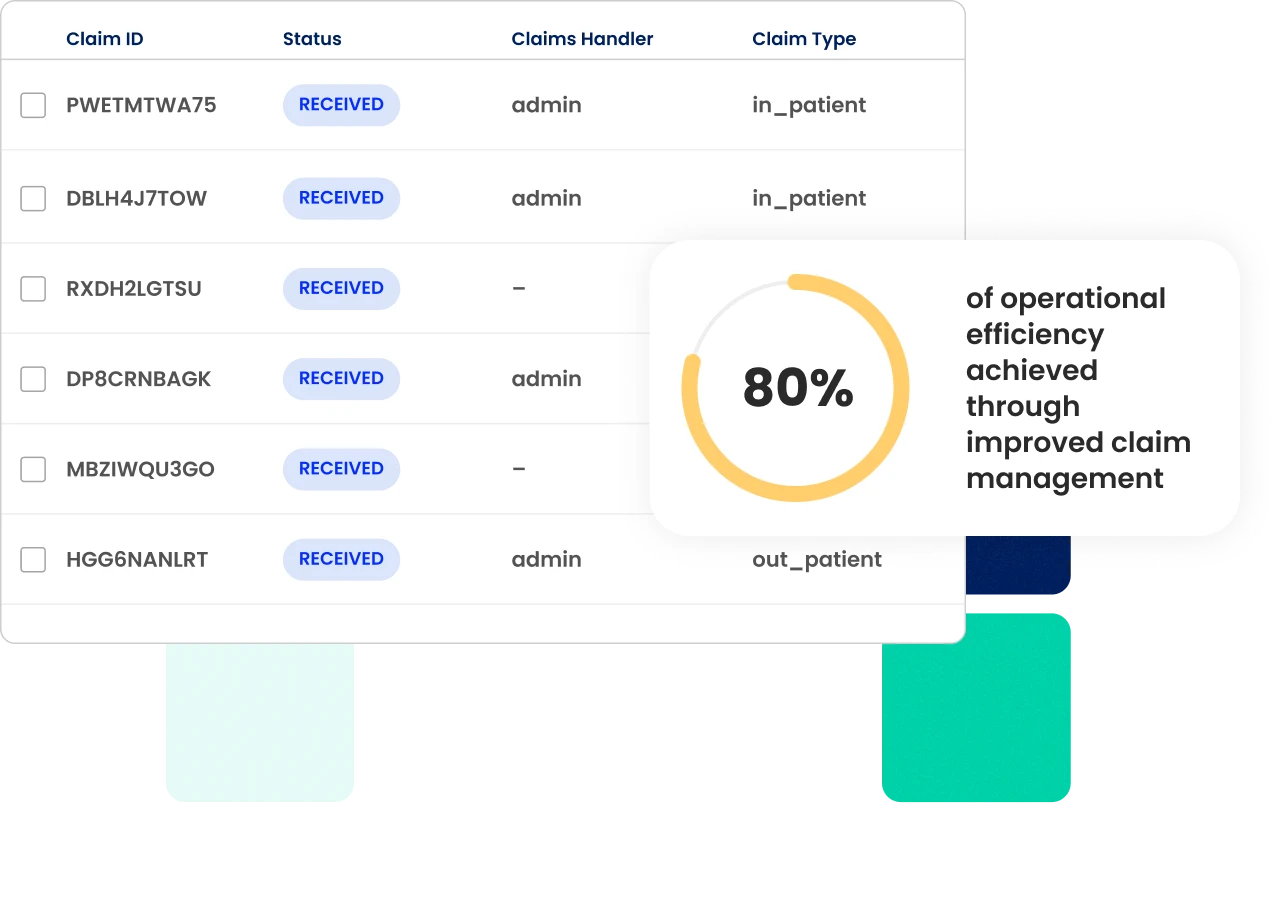

Automate up to 60% of your claims processes, ensuring a seamless and efficient workflow. Our user-friendly platform streamlines the entire claims lifecycle, reducing manual workload and increasing overall efficiency.

The one and only end-to-end core platform supporting health, life, and P&C insurance product lines.

Streamline your health insurance ecosystem at record speed with CoverGo’s end-to-end core insurance platform for individual and group health.

Build, launch and distribute any type of life insurance product. Policy admin system and claims management coming soon.

Build, launch and distribute any personal or commercial property & casualty insurance product. Policy admin system and claims management coming soon.

Next-gen, end-to-end claims management platform to drastically reduce costs, increase accuracy and speed, and elevate satisfaction.

CoverGo consists of modules that can be assembled fast to address specific gaps in existing systems or deliver end-to-end improvements based on your needs. Open insurance APIs, robust microservices architecture and patented no-code product builder provide maximum flexibility and scalability, enabling you to be future-proofed in the fast changing world.

Delivering a digitally-enhanced and connected journey futureproofs our business and provides an exceptional experience for our customers.

Yuman Chan, General Manager of Bupa Asia

Whether you are a large global or small insurer, CoverGo is the right choice if you are looking to:

Insurers have complete choice to deploy the CoverGo platform depending on their specific needs and strategic objectives. Our global team of delivery experts ensures that every deployment is executed to the highest standard.

Adopt CoverGo as a digital layer on top of your existing system. You can integrate with any legacy or third party systems thanks to our open API-driven architecture.

Adopt CoverGo in full, replacing your existing core system and migrating your portfolio to CoverGo.

Adopt CoverGo as a greenfield platform to launch new products and digital-first initiatives without legacy constraints.

Up your distribution game with our next-gen, no-code, AI-powered insurance platform.

With a team of experts boasting over 500 years of combined experience in insurtech and insurance enterprise software, we are catered to serve as your dedicated technology partner. Our expertise is truly global, with a team of over 140 experts representing 35 nationalities and clients utilizing CoverGo across Asia, EMEA, and the Americas.

With over 50,000 followers on LinkedIn, CoverGo has established a powerful brand and thought leadership in the global insurance industry, with appearances and features in over 100 industry events and media outlets. Follow us on LinkedIn for our latest updates!

CoverGo is backed by leading US insurtech and fintech VC funds and strategic investors from the US, Asia, Africa, and the Middle East

An innovative no-code drag-and-drop tool empowering business users to swiftly build, configure, and launch products

For information security, protection of client data, and operational excellency