Client background

Techcombank was established in 1993, just as Vietnam was beginning its transition from a centrally planned to more market-oriented economy.

Starting with only VND 20 billion in charter capital, Techcombank has come a long way and today is Vietnam’s 3rd largest bank by profit. Our success is driven by our strategy of focusing on customers and their evolving needs. The next five years our focus on customers will not change but our products and services will be further enhanced, being enabled by our stronger than ever investments in digitalization, data and talent.

Techcombank’s customers seek autonomy; they own their desire for success on their own terms. Our mission is to lead the digital transformation of the financial industry, enabling individuals, businesses, and corporations to progress and thrive sustainably. We believe a society can only prosper when its people are financially empowered.

We provide a broad range of products and services to over 8.4 million retail and corporate customers in Vietnam. Our extensive network comprises 312 branches and transaction offices across 45 cities and provinces.

The challenge

-

TCB’s bancassurance process requires accurate and lengthy customer data capture; human errors are not accounted for because there was no digital validation process or digital solution capturing the data and ensuring it was compliant or correct.

-

Data didn’t communicate in real time as it was all done by hand, delaying the processing of policy applications and requiring redundant data entry across multiple stakeholders.

-

Unsatisfying and inefficient customer experience due to all the challenges above.

The solution

Techcombank web app (iTCB Life) for TCB staff to fill in the Financial Need Analysis form (“FNA”) for its corporate customers and generate BFNA form and recommend suitable products before handing over the information to ManuLife representatives.

-

Advisor completes the necessary forms with customer data and data for selected product(s) where unnecessary pages / questions are automatically filtered out.

-

The appropriate ManuLife product is recommend out of four.

-

The FNA is generated into a PDF with the digital input.

-

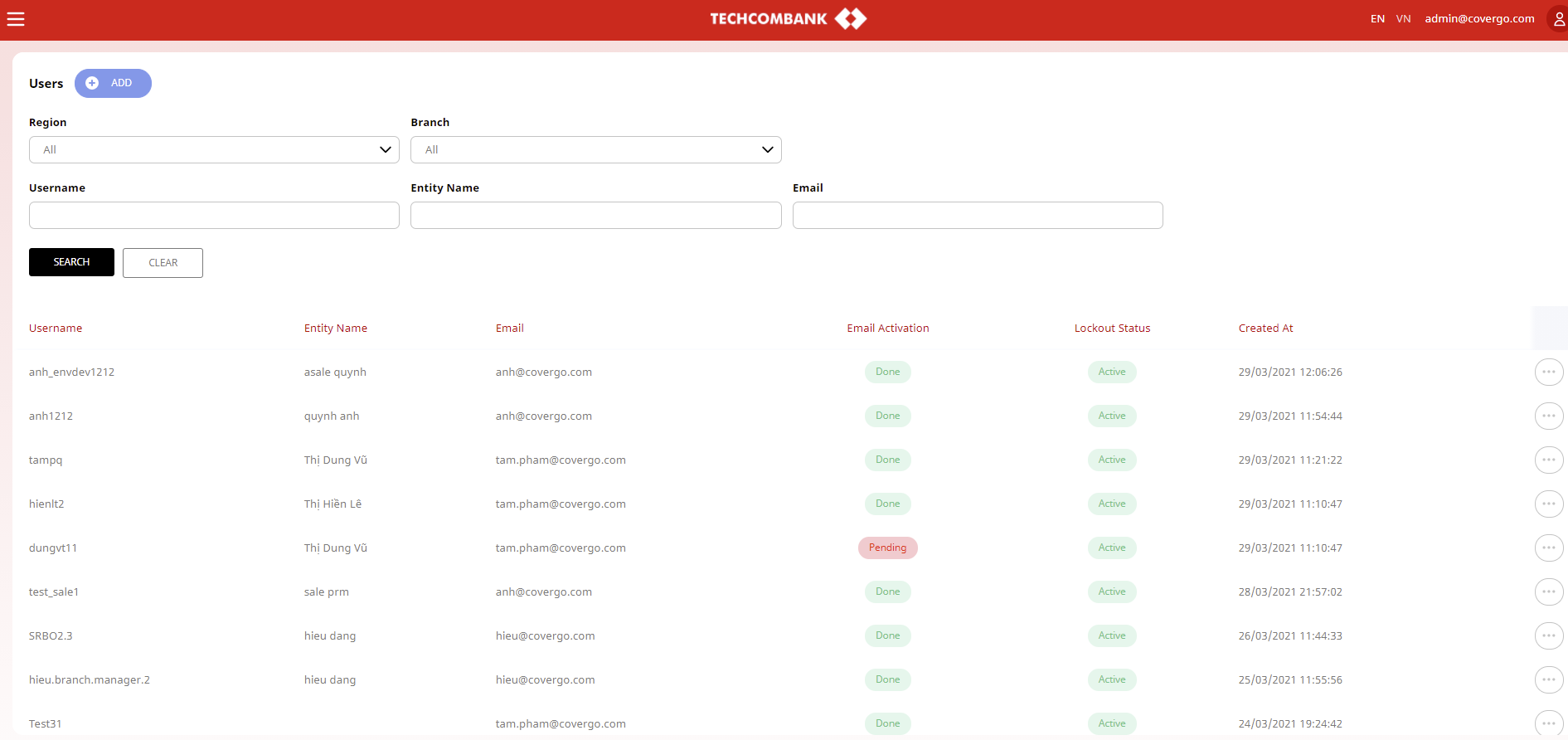

Entered data is passed to CoverAdmin system so the internal staff can manage submitted cases.

Business impact

-

Gained customer satisfaction on its professional services in onboarding clients to products with a frictionless and user-friendly customer experience.

-

Shortening of customer onboarding and policy processing lead time while customer satisfaction increased.

Testimonial

Terry Li, Head of Insurance of Techcombank: Vietnam is one of the fastest growing insurance markets in ASEAN propelled by the young population and strong GDP growth. As one of the leading banks, TCB is committed to serve our customers with the best protection advisory service and solution to meet their different needs efficiently. We are very excited to enable our entire branch network with the game changing tool iTCBLife, with firm belief that this will accelerate our customer-centric growth strategy. We are delighted to have CoverGo be our partner and make this innovative idea a reality together.

Pranav Seth, Chief Digital Officer of Techcombank: To achieve our vision of “Change banking, Change lives”, Techcombank is embarking on a customer-centric, data and digital first transformation. With the increasing demand for insurance in a post-pandemic world, digitally augmenting our front line to have personalized conversations with each client is a core priority. Our partnership with CoverGo will enable this experience and builds on our open innovation approach to partner and co-create with leading fintech companies across the globe.