Client background

Fubon Group was established in 1961 with headquarters based in Taiwan. The group has diversified business in financial services, property development, telecommunications & media, culture & creative sector, health management and philanthropy. As the key business unit of the group, Fubon Financial Holding Co., Ltd (“Fubon Financial Holdings”) (TWSE stock code: 2881) is a leading financial holding company offering banking, property and casualty insurance, life insurance and security brokerage services.

Fubon Life Insurance Company Limited (“Fubon Life Insurance”), which is a wholly owned subsidiary of the Fubon Financial Holdings, is a leading insurer in Taiwan. In Hong Kong, Fubon Life Insurance (Hong Kong) Company Limited (“Fubon Life Hong Kong”), a wholly owned subsidiary of Fubon Life Insurance, was authorized as a long term insurer in 2016. Through diversified sales channels, Fubon Life Hong Kong is committed to satisfying customers’ needs in savings, protection and financial planning.

The challenge

Fubon Life wanted to reach new clients for the savings + protection product through online distribution, yet faced challenges since there was no digital onboarding experience for users to be able to self-service and customize their plan; adding on the fact that the onboarding process was long and there was no way for the information to be saved for later, customer onboarding was difficult, tedious and unappealing.

The lack of digital onboarding meant that there was a large amount of redundant data entry from long form processing – needing to transfer all the information across multiple stakeholders and platforms

They also wanted to increase conversion rates through retargeting, securing higher form application rates and lower dropouts.

The solution

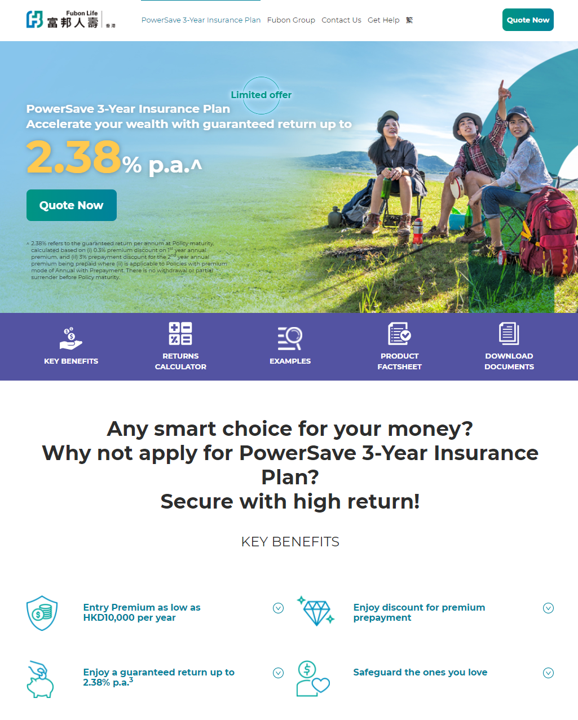

CoverGo has built, a new digital distribution platform for Fubon Life: echannel.fubonlife.com.hk, offering customers in Hong Kong an additional choice to purchase personal life insurance through a self-directed and digital means.

Business impact

-

Improved customer satisfaction on its professional services in onboarding clients to products with a frictionless and user-friendly customer experience

-

Increased customer retention by enabling automated marketing notifications and account creation to save progress

-

Lowered customer acquisition cost by offering self-servicing and policy processing lead time while customer satisfaction increased.

Testimonial

Mr Jerry Chou, CEO of Fubon Life Hong Kong, said, “Online distribution has been playing an emerging role in the market and more consumers are switching to purchase digitally during the pandemic moments. To develop our capability in financial technology is one of the critical paths to meet our customers’ needs and enhance customer experience. Fubon Life Hong Kong is committed to investing in the infrastructure to provide better products and services for our customers.

Fubon Life Hong Kong is glad to appoint CoverGo which is instrumental to our successful launch of the e-Channel. It has proven expertise in developing online insurance platform to help enhance customer experience and gain a competitive advantage. CoverGo’s no-code, api-driven and modular technology allows Fubon Life Hong Kong to develop the e-Channel which is scalable, efficient and fits for our business needs. It also enables an improved seamless digital user experience for Fubon Life Hong Kong customers, such as faster onboarding and streamlining policy application process.”