The insurance industry as we know it is currently on the verge of being reimagined in a completely digital landscape.

The widespread digital disruption has forced insurers to diversify their offering and align them to the changing demands of their clients. A direct result of this has been the added emphasis on introducing cloud-based digital innovations and fostering a new ecosystem that can sometimes rely on third-party tools and their ability to connect, send and receive data, and make changes to one another.

There are a million things that are disrupting a lot of industries, AR, AI, automation, mobile apps, and so on. But these buzzwords can’t work without one crucial thing that connects them to everyone’s home system: APIs.

API stands for Application Programming Interfaces. Don’t worry about this part, this next part is what you really need to know if you’re diving into this stuff for the first time.

A key element of any digital ecosystem, not just in Insurance, APIs are the link between tools, databases, and servers that amount to what we know today as “software”. No longer are we in the age of downloading .EXE files and executing a program one by one to get work done. Oftentimes, digital products are not one software, but an ecosystem of many software working together.

APIs are the only true bottleneck for any industry looking to digitalize its assets, so it’s important to understand how they work. You don’t need to be an engineer to read on, we’ll go over the importance of APIs, use cases with APIs in insurance software, and more.

What is an API?

In simple terms, API refers to a system through which computers or applications can communicate with one another. You can think of APIs as a layer sitting between an application and the web server. It serves as the intermediary and processes the relevant data for transfer.

Using API, you can pull out the exact data you need and then present it in a way that benefits you.

Amazon is (supposedly) touted to be the first conglomerate to push for using APIs to support its growing data needs and act as a bridge between various divisions, vendors, and service providers. APIs enabled various departments of Amazon to access information more swiftly and meet the user’s specific data needs in an agile manner, which is extremely important in a global e-commerce powerhouse with orders propagating through both warehouses and software databases thousands of times an hour.

Some of the key benefits of using APIs include the following:

Better collaboration

APIs ensure that there is seamless integration between various platforms and apps. This leads to automated workflows and improves workplace collaboration. In the absence of APIs, there is a possibility of too many informational silos operating within an organization, leading to productivity issues.

Think Google Office versus Microsoft Office. Google docs are part of a digital ecosystem that is accessible by Google users in an organization. Data from Google Sheets created by User A can be retrieved by User B and shown on Google Slides. Meanwhile, on Microsoft Excel, User A would have to make a copy of that file, send it to User B, who needs to open that file, and then move over that data manually to PowerPoint.

Yes, we know the latest version of Microsoft Office now has this online collaboration feature, but we all remember the old days which can still exist in many organizations.

Improved innovation

Using APIs, companies can forge better connections and offer flexibility to their business partners. APIs can also help enterprises access newer markets and achieve superior returns through partnering with other digital services that can enhance their product and give them an edge in the market.

A great example is Stripe which started out as an API provider and has since partnered with several enterprises across the globe to offer loans and corporate credit cards.

Data monetization

APIs allow access to valuable digital assets which can be monetized. So even if APIs are offered for free, there is potential to earn money in the process. APIs sometimes run on a credit system by which the number of automation, number of data sends, or file sizes can be monetized and offered to API customers who need them.

For instance, if a user on a CRM platform needs access to a lead-generating database that automates the introduction of new contacts who match a certain profile, sending that user over may comprise 1 credit on their lead database.

Enhanced security

APIs offer an added layer of security between the server and the data. They can be further strengthened by using tokens, signatures, and Transport Layer Security (TLS) encryption.

Even if all the tools in an ecosystem are completely internal to an organization, instead of stitching them together in one software batch, an organization can optionally host those tools separately on different platforms and servers, and then API integrates them together. This style of API management can lead to redundancy in the ecosystem so that if one tool fails or is compromised, the whole ecosystem can be bifurcated from the affected area.

APIs in the insurance industry

The adoption of APIs in the insurance industry hasn’t been at the same pace when compared to, say, financial services for instance. However, it is estimated that in the past few years, there has been a surge in the adoption of APIs within insurance organizations, and this trend is here to stay. In fact, a survey conducted by Accenture in 2020 revealed that 75% of insurers believed that a chunk of their revenues would come from APIs supporting various ecosystems in the open insurance market.

There are several reasons for embracing APIs in the insurance sector. Foremost, they can help create a bridge between customer expectations and how businesses cater to those. By enhancing connectivity and increasing interactions, APIs can make it easy for insurers to access data through a standard protocol, whether in-house, on the cloud, through the insurer’s app, or any other device.

Secondly, APIs can go a long way to enhancing the customer experience. Through integrations with third parties and partners, they can help create a digital ecosystem that can attract and retain new customers and sell more products to existing ones. We call this digital distribution, and yes, APIs exist here too.

Using APIs in the insurance sector also enables companies to enhance productivity within the organization by converting repetitive tasks and complex processes into simpler and more usable ones. Streamlined underwriting and claims processes also help improve customer experience as they benefit from faster delivery of services.

Insurance API Use cases

Here’s a detailed look at the various use cases of APIs within the insurance sector:

Speedy claims management

Insurers can employ APIs to minimize friction between claimants, carriers, and adjusters. Gone are the days of claimants filing a million physical forms to kick off the process.

APIs can integrate with different systems and internal & external data sources and help insurers to process claims more accurately. For example, insurance carriers use APIs to integrate with an external service that can click photos of cars in accidents and store them on a secure server. The images can be submitted at the time of claims processing without having the insurer develop the capability in-house.

APIs can also help policyholders to upload photos or videos of any damage caused to the vehicle along with the first notice of loss and receive instant approvals. They can be equally helpful in assisting customers during accidents or breakdowns as they can pinpoint the location where the car is stuck, enabling insurers to dispatch help.

A faster and smoother claim resolution can lead to better customer satisfaction, improve retention rates, and result in higher profits.

Risk mitigation

Since APIs can be connected to any device, they can be employed for data collection to identify potential risks. For example, APIs can pull out data about humidity fluctuations and changes in water pressure and temperature in a building. Insurers can use the data to suggest relevant mitigation strategies to the building owner when signing off on the insurance policy to safeguard the structure against natural disasters.

Customized product offerings

Insurers need to crack the code of personalization to succeed in the current market. APIs can be leveraged for delivering a higher degree of personalization and tailor-making the offerings as they can quickly and securely transfer an enormous amount of data gathered through AI and ML.

For insurance, if someone applies for vehicle insurance, API integration with the ecosystem can fetch relevant customer data, work out the insurance quotes through a dynamic risk assessment and offer them to the customer.

Efficient underwriting

Pricing the risks adequately is critical for insurance companies. For increased efficiency in the underwriting process, insurers can employ APIs that can access more data and automatically match it with similar data collected from multiple sources.

For example, when a customer applies for a health insurance policy, you can get the APIs to collect relevant patient data from patient portals, labs, and pharmacies to accelerate your decision-making process. With a simple authorization from the customer, you can access everything you need to decide whether you want to approve the policy and quantify the risk.

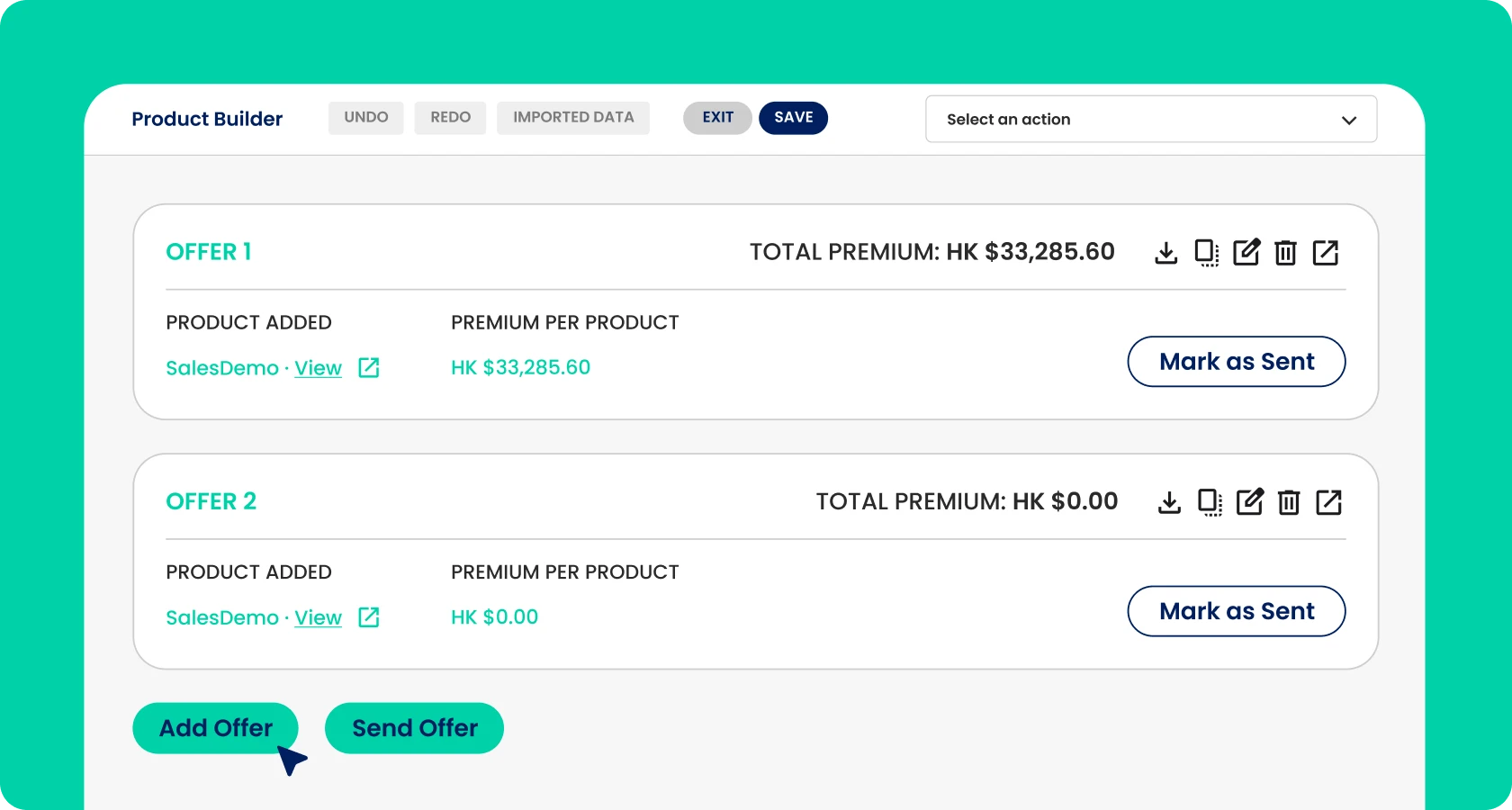

APIs are at the heart of CoverGo. We offer access to 500+ APIs that have been specifically designed to deliver superior insurance solutions. It has one of the most comprehensive sets of insurance APIs in the market, enabling you to adapt and configure everything to the unique needs of your business. Based on your requirements, you can use them in parts or full to improve your frontend and backend processes, integrate with various third-party apps, and much more, thanks to the real-time sync.

APIs are the future

The future of insurtech is unfathomable without APIs and integrations.

Since the growth of the internet, APIs are touted to be one of the critical factors in driving the insurance industry forward. Given that they can improve claim processing speed, increase accuracy, and streamline complex processes, anyone choosing to ignore them shall do it at their peril. API integrations offered can help you disrupt your digital transformation entirely. Schedule a demo with CoverGo immediately and step into a world of limitless possibilities.