In the rapidly evolving landscape of the insurance industry, adapting to change is not just an option – it’s a necessity. With the advent of technology and the demand for enhanced customer experiences, insurers are reconsidering their traditional in-house core systems in favor of more agile and efficient Software as a Service (SaaS) platforms. This paradigm shift marks a significant departure from conventional practices and holds the promise of improved operational efficiency, flexibility, and customer satisfaction.

Is sticking to legacy systems still viable?

Traditional insurers have long relied on in-house core systems to manage their operations. While these systems were effective in their time, they often lack the agility required to keep up with the demands of modern business environments. Legacy systems can be complex, difficult to update, and costly to maintain.

As the industry witnesses a surge in data-driven decision-making, personalized customer experiences, and seamless digital interactions, the limitations of these systems become glaringly evident.

Many insurers are inadvertently turning a blind eye to the clear signs that their legacy systems are impeding their progress. These systems, once robust, are now proving inflexible and slow to adapt to the demands of a rapidly evolving industry. The signs are evident in the disjointed customer experiences, prolonged product development cycles, and the struggle to keep up with data-driven insights that competitors are leveraging to their advantage.

The costs of maintaining and patching these systems are draining valuable resources that could be invested in innovation. Ignoring these signs not only stifles growth but also risks alienating customers who expect seamless digital interactions. The urgency to break free from these outdated constraints and embrace modern technologies has never been greater, as the insurance landscape demands agility, efficiency, and customer-centricity to thrive in the digital age.

Enter SaaS Platforms

The rise of insurtech platforms has redefined the insurance industry by merging cutting-edge technology with innovative business models. These platforms leverage advanced technologies like AI, data analytics, and IoT to enhance operational efficiency, improve customer experiences, and introduce agile, data-driven solutions.

Focusing on customer-centricity, cost-efficiency, and global accessibility, insurtech platforms are transforming traditional insurance practices, fostering collaboration, and revolutionizing risk assessment, all while propelling the industry toward a more digitally-driven and customer-oriented future.

These platforms offer a range of benefits that are hard to ignore:

Agility and Flexibility: SaaS platforms are designed to be adaptable to changing business needs. Insurers can easily scale their operations up or down, introduce new features, and integrate with other technologies without the constraints of a legacy system.

Cost-Efficiency: Building and maintaining in-house core systems can be a significant financial burden. SaaS platforms operate on a subscription-based model, eliminating the need for upfront infrastructure investments and reducing ongoing maintenance costs.

Faster Speed-to-Market: With SaaS solutions, insurers can accelerate their time-to-market for new products and services. The streamlined deployment process allows for quicker implementation, enabling companies to respond swiftly to market trends and customer demands.

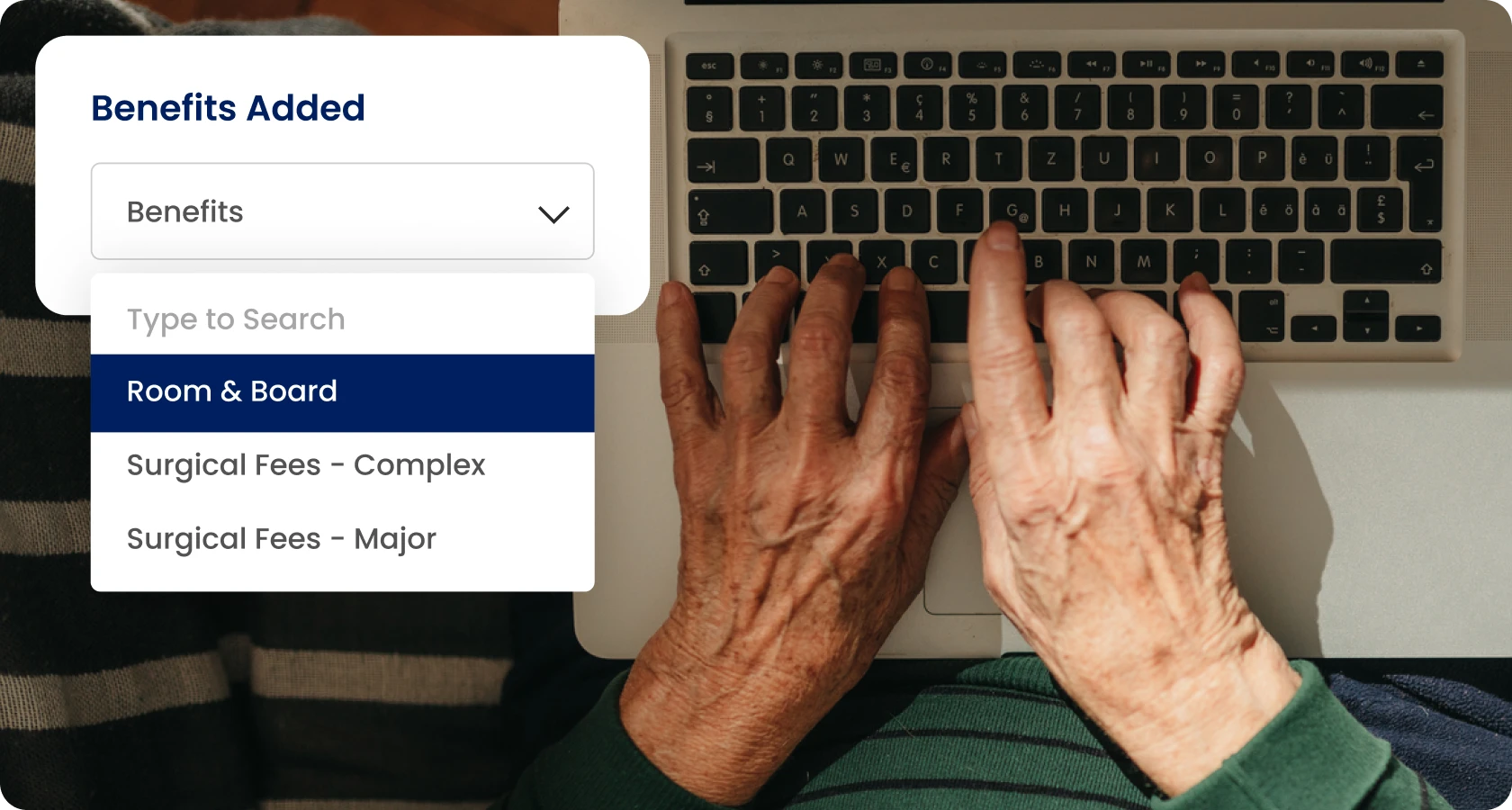

Enhanced Customer Experiences: SaaS platforms often come with built-in tools for data analytics and customer relationship management. This empowers insurers to personalize their offerings, provide better customer support, and ultimately improve customer satisfaction.

Security and Compliance: Reputed SaaS providers invest heavily in robust security measures and compliance standards. This ensures that sensitive customer data is protected and that insurers can meet regulatory requirements without the need for constant updates to their systems.

Focus on Core Competencies: By outsourcing core system management to SaaS providers, insurers can divert their internal resources towards innovation, customer-centric initiatives, and strategic growth rather than routine system maintenance.

Challenges and Considerations

The transition from legacy software to modern insurtech platforms presents insurance companies with several significant challenges. Data migration, a complex and often risky process, requires careful planning to avoid loss or corruption of crucial information. Change management becomes imperative as employees accustomed to traditional systems might face difficulties adapting to new technologies and workflows.

Moreover, navigating the complex regulatory landscape while ensuring compliance during the transition adds an additional layer of complexity. Despite these hurdles, successfully overcoming these challenges can lead to streamlined operations, enhanced customer experiences, and a competitive edge in the ever-evolving insurance landscape.

Here are some main challenges that insurers face when moving from legacy to modern systems:

Data Migration: Migrating data from legacy systems to SaaS platforms requires careful planning to ensure a smooth transfer without data loss or disruptions.

Change Management: Employees accustomed to traditional systems might resist the transition. Proper change management strategies are necessary to ensure a smooth adoption process.

Integration Complexity: Integrating the SaaS platform with existing technologies and third-party systems requires a thorough consideration of compatibility and interoperability.

Vendor Selection: Choosing the right SaaS provider is crucial. Factors like reputation, security measures, scalability, and support must be carefully evaluated.

Making the move

In an industry where adaptation is key to survival, insurers are embracing the benefits of SaaS platforms to revolutionize their operations. The transition from in-house core systems to SaaS offers insurers the tools they need to navigate the demands of the modern marketplace, enhance customer experiences, and drive innovation. While challenges exist, the potential rewards far outweigh the hurdles, making SaaS platforms an attractive choice for insurers seeking growth, efficiency, and agility in an ever-changing landscape.

If you’re an insurer that’s mulling the move from your legacy system to something more modern, contact our experts at CoverGo, and we’ll show you how our platform helps insurers across the globe reach their digital potential.