Latests posts by FINAOStarterAdmin

How legacy systems are holding back health insurers

Health Core Systems

The ultimate guide to insurance APIs in 2023

Insurance APIs

10 Ways Insurance Technology Create Cost Savings

Insurtech

10 Insurance technology trends in 2023

Insurtech

How to Improve Customer Experience at Your Insurance Company

Insurtech

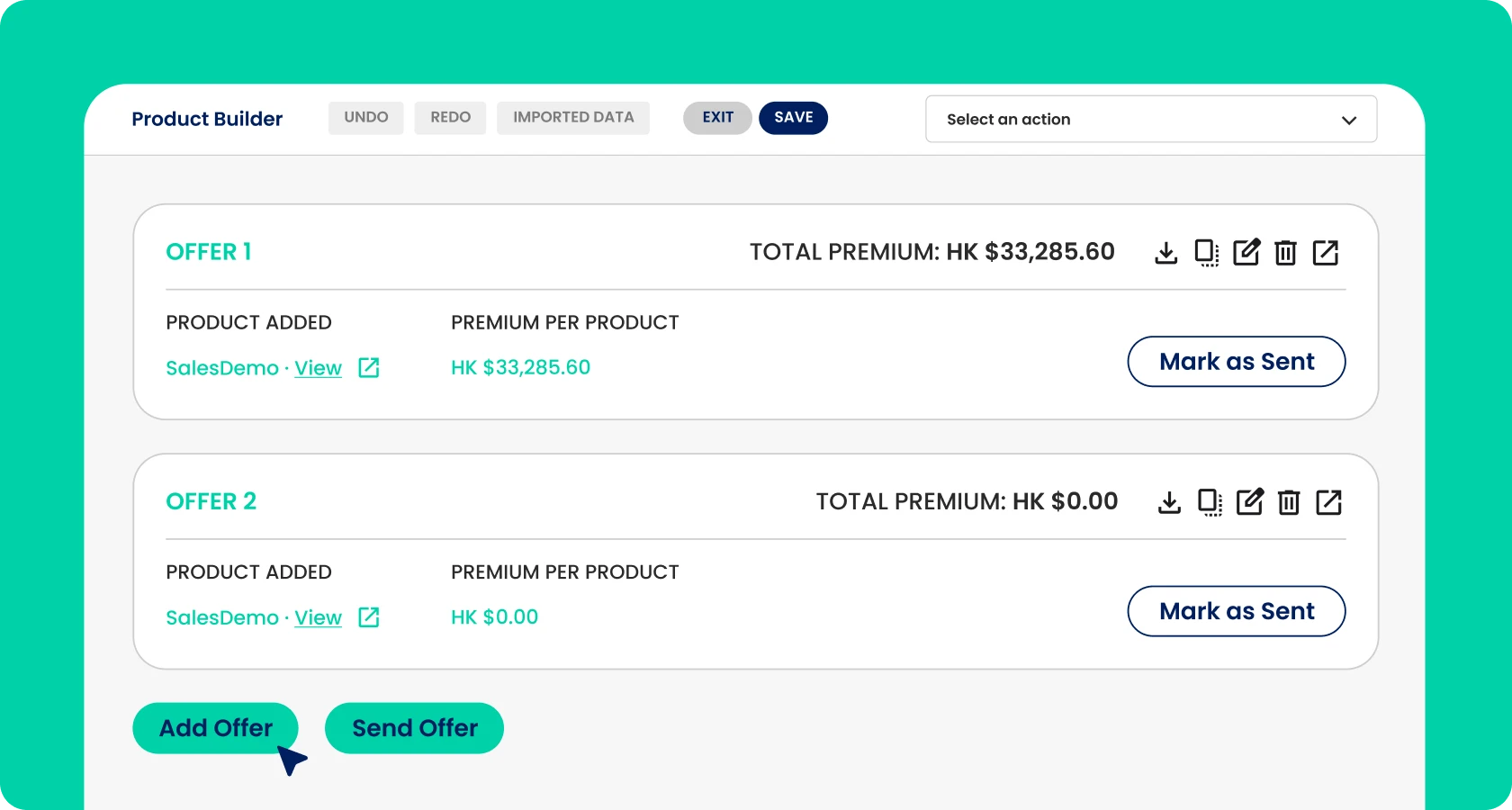

Digital Distribution: A Pivotal Innovation for Insurance Companies

Digital Distribution

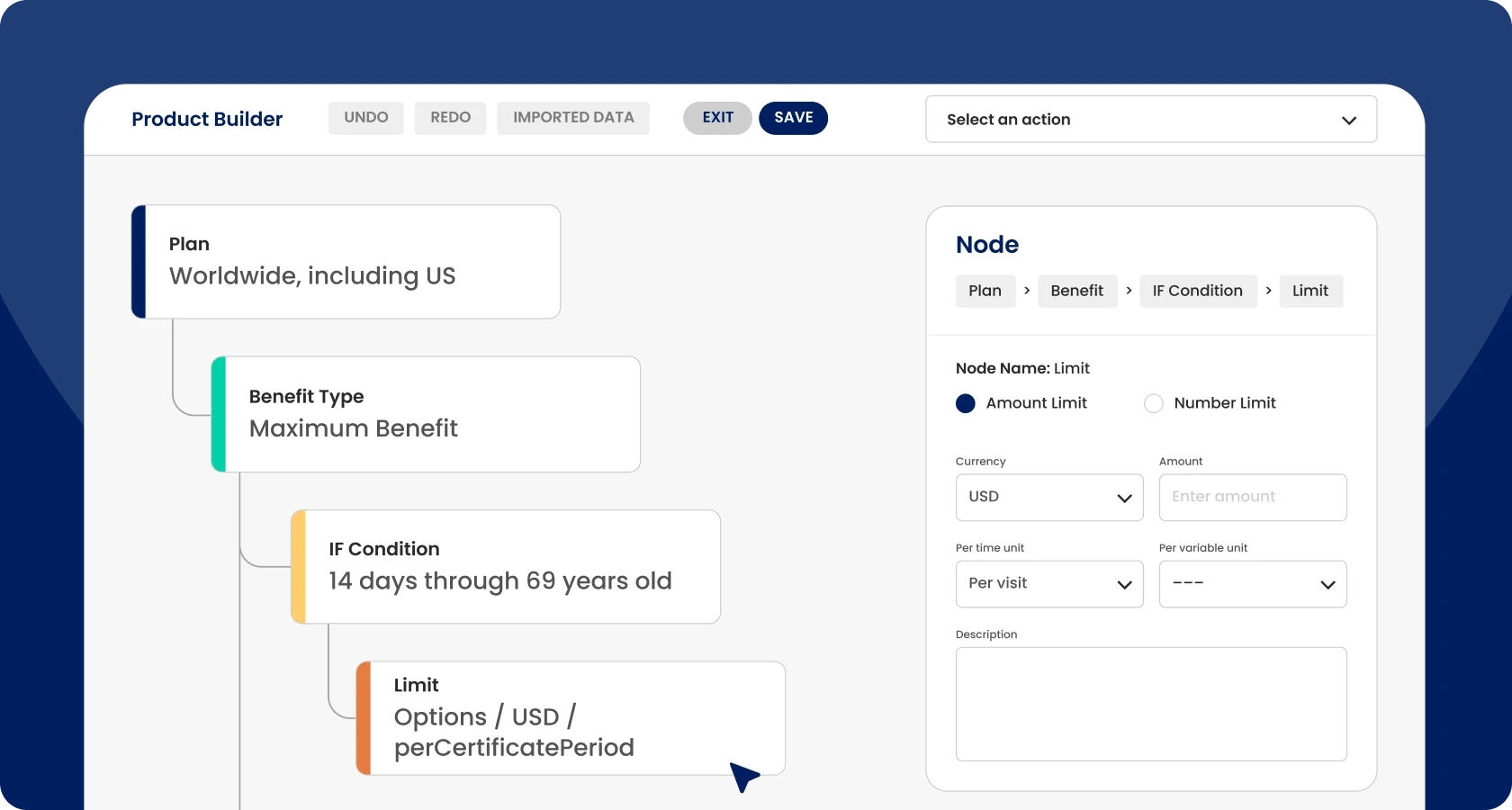

What is No-code Insurance Software?

Insurtech

Embedded Insurance is the Future: Here’s How to Make it Happen

Embedded Insurance

How to Digitally Transform Your Insurance Company

Insurtech