Latests posts by FINAOStarterAdmin

Health insurance disruption is killing the legacy core system

Health Core Systems

7 Trends in insurance claims management 2023

Claims Management

Why personalization is critical for growing health insurers

Health

Transitioning from legacy systems to modern insurtech platforms

Insurtech Core Systems

What is insurance management software?

Insurtech

Why policy admin systems need an upgrade

Policy Administration

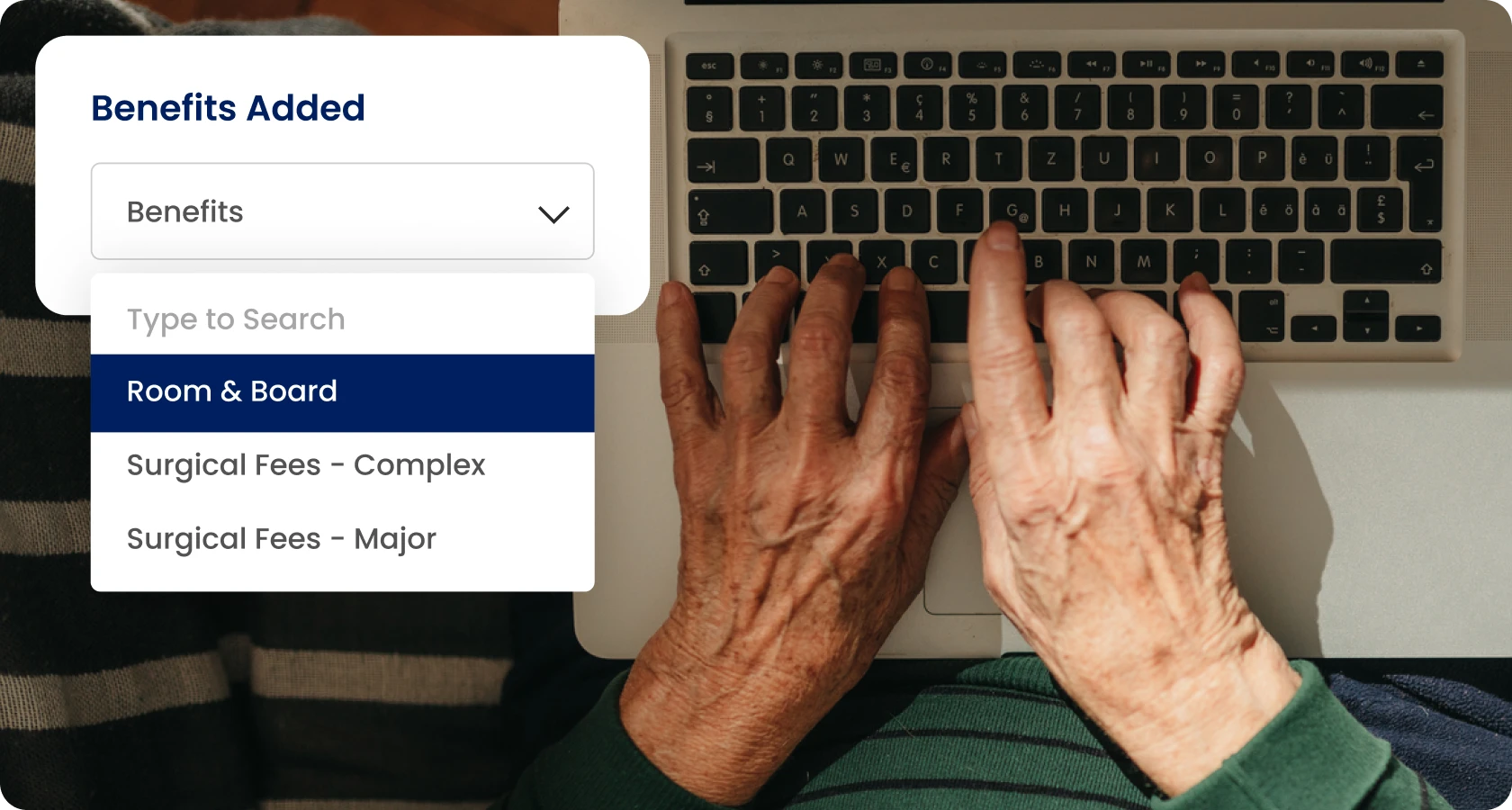

Why health insurers need better product flexibility

Health

Should insurers integrate with insurtech platforms?

Insurtech

Why old-school thinking is holding back the insurance industry

Insurtech

Why customer experience is crucial for health insurers

Health

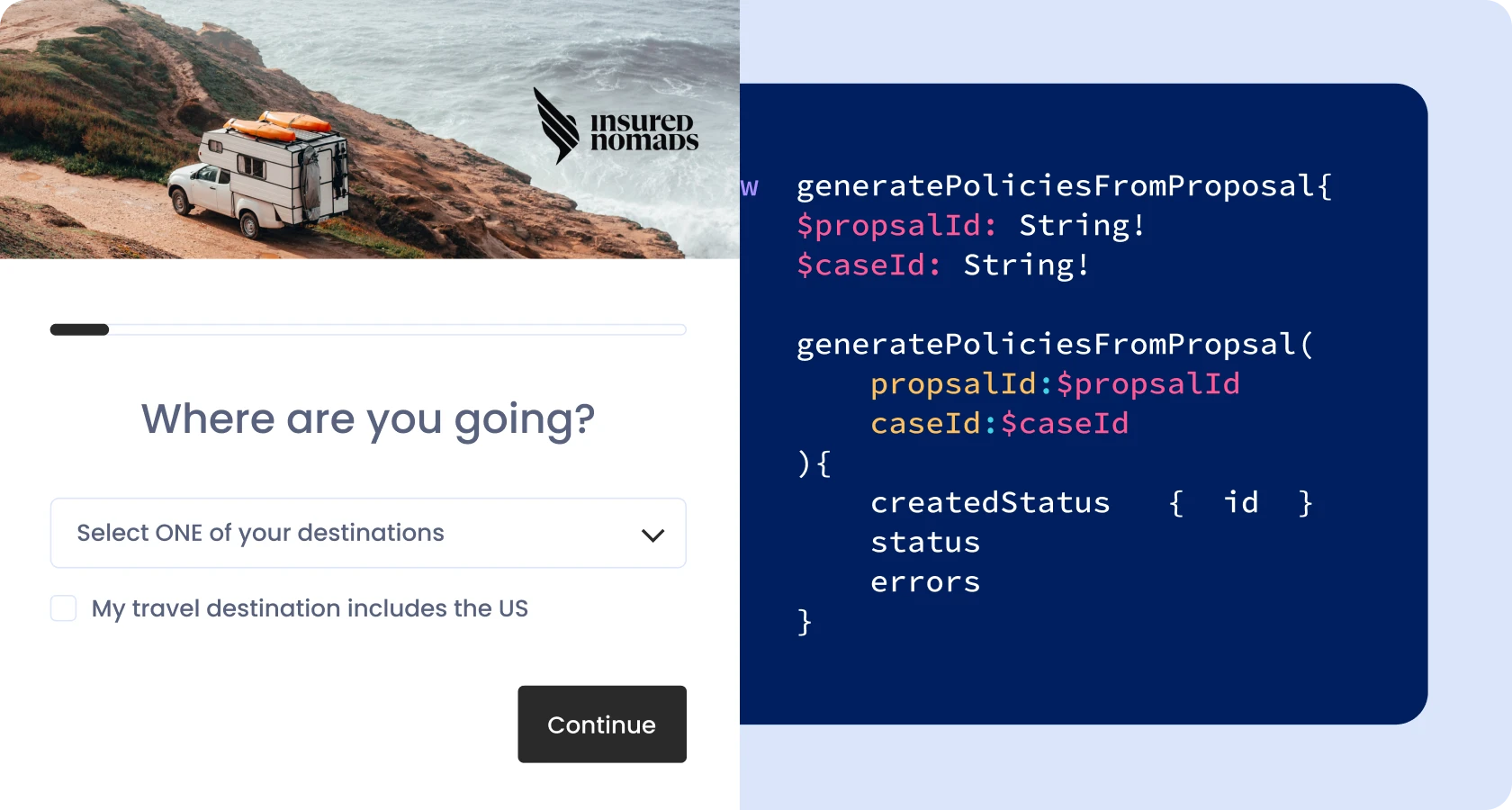

The Role of APIs in the digitalization of insurance companies

Insurance APIs

10 Ways to improve insurance claims processes

Claims Management