Insurance companies are on a never-ending mission to simplify existing systems. To push the boundaries, there is a need for an accelerated digitalization of the industry to keep up with the changing user expectations. And the digitalization efforts are no longer about improving the efficiency and productivity within the firm — efforts must be across the board for an end-to-end digital experience.

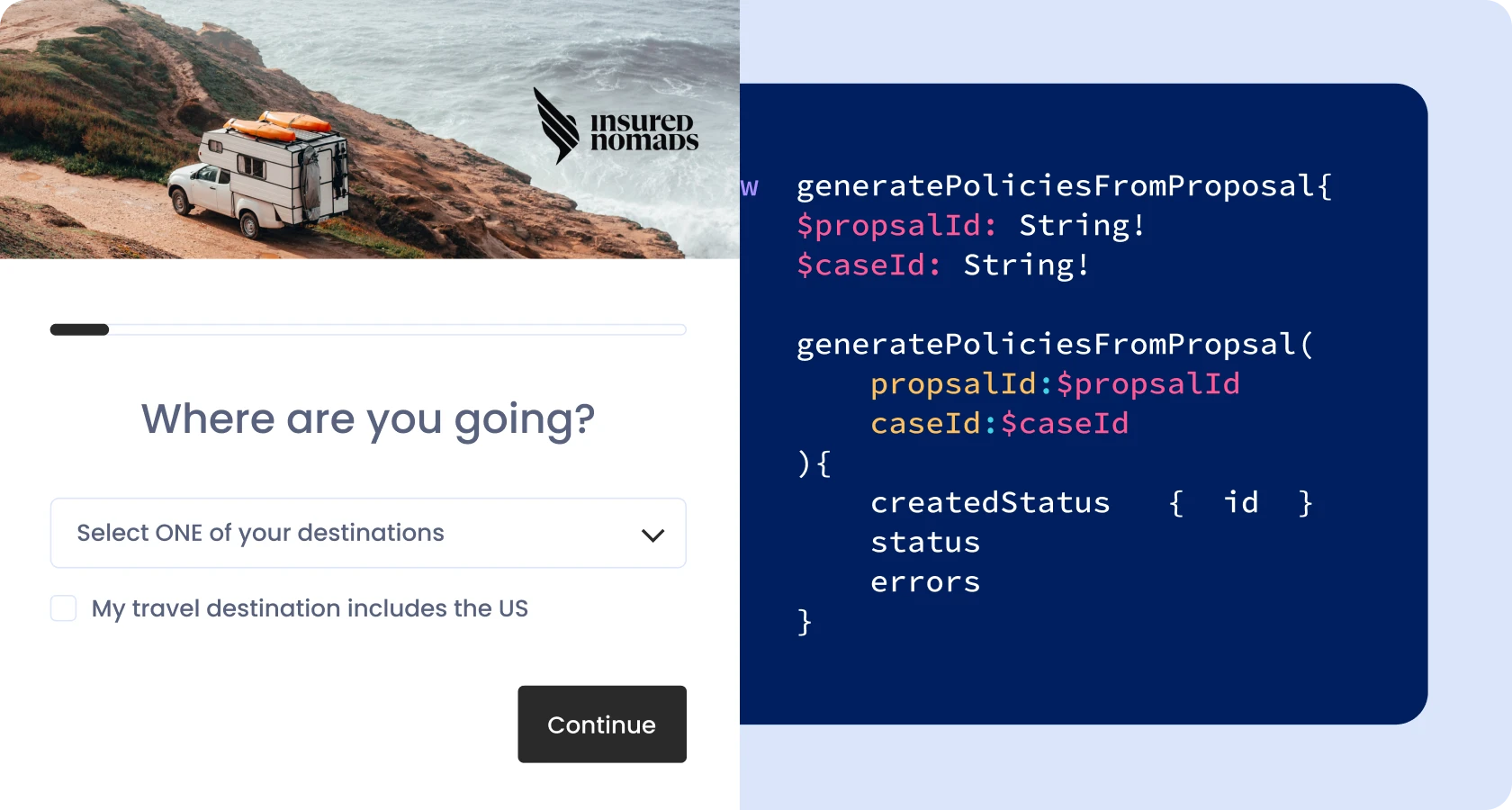

One of the fundamental building blocks to make it possible is through Application Programming Interface (API).

What is an API?

In simple terms, API can be defined as little pieces of code that allow various devices, software applications, and data servers to communicate with each other and provide responses.

You can think of APIs as your waiter who takes your order at a restaurant and relays it to the chef so that you are served the exact dish you have ordered. If the waiter (the API here) is missing, the medium to communicate your order to the kitchen so that you get the order you want would be impossible.

Anytime an insurance agent has to pull out data from one system to another for selling a new policy or processing a claim under an existing one, APIs can be used. APIs make the communication between different touchpoints absolutely seamless and act as the key driver for digitizing the insurance business.

Luckily, you don’t have to be a tech expert for using APIs. Platforms such as CoverGo offer 500+ APIs that can be directly integrated with your ecosystem. All you need to do is select the information you want to relay through API.

Types of APIs in the insurance industry and who uses them

Before adopting an API-first approach, it is worth examining who uses APIs in the insurance business and how are they used in practice.

Agents, insurance providers, and carriers can all use APIs albeit for different purposes. For example, APIs employed by insurtech firms can aid in customer management and data analytics whereas insurance agents may use APIs for collating various marketing data and storing client records. Carriers can use APIs to automatically display quotes to customers while they are browsing aggregator platforms, eliminating the need for manually processing requests for quotes.

APIs used by the insurance industry can be classified into four key categories:

- Data aggregation – This API allows insurance companies to pull out relevant information from a research company for its landing page.

- Workflow – This API can be used for sending notifications to an insurance agent as soon as a prospect fills out a form on the website to apply for a new policy

- E-commerce – The checkout page of the insurer’s website can use such an API for supporting credit card payments etc.

- Quoting – Insurance aggregator platforms can use such APIs for displaying policy quotes to the customer from various insurers

In most cases, the APIs overlap and are used in conjunction with each other. To help drive insurance companies on the path of digitalization, APIs should have a format that is easy to integrate with existing systems and simple to understand for all stakeholders.

This ensures minimal hiccups during the initial implementation. The structure of API should be such that instructions are fed seamlessly and the final product is delivered as expected. After all, APIs make the task of selling insurance easier by automating manual tasks.

APIs are the heart of every product that CoverGo offers and insurance companies can use. They are extremely comprehensive and powerful for improving any insurance process, whether at the front or back end.

They are also process-agnostic which means they can be synced with any product or system, old and new. CoverGo’s API capabilities also offer seamless integration with the insurer’s ecosystem, third-party apps, and other CoverGo products so that you can witness the change in real time.

How APIs support the digitalization of the insurance industry

Integrating APIs can open up a new world of possibilities for insurers by enabling them to offer a higher degree of personalization for their customers. API-led connectivity also helps insurers to simplify complicated and repetitive tasks to enhance productivity within the firm. In other words, APIs not only promote better efficiency for insurance firms but also deliver better experiences for the end customer.

Here is a breakdown of the key benefits APIs can provide to insurers who are keen to go digital:

Supports customized offerings

APIs make it possible to offer products based on usage trends and the needs of customers. For example, APIs can support integration between various mobile and web applications of the user and the insurer’s platform to track the user’s behaviors. This can help insurers come up with customized offerings in real time. This can be particularly beneficial for insurers as more and more customers are expecting a frictionless digital experience.

A case in point would be when a customer wants to purchase auto insurance, APIs can fetch the relevant customer data and generate a customized quote based on the unique risk profile of the applicant. It can also use a dynamic risk assessment for offering tailored quotes such as a pay-per-mile program for those who have a car but drive it infrequently.

Simplifies damage assessment and claims processing

Assessing the damage is an extremely time-intensive activity for most insurers. If not done correctly, it can have an adverse impact on both the customer and the insurer. Typically, when insurers are notified about damage or loss, they send someone on-site to assess the damage, which costs thousands of dollars every year.

Using APIs supports automatic damage assessment using straight-through processing initiated by the customer, resulting in faster claims processing. With the help of artificial intelligence, spatial analytics technology, image, and video data labeling, insurers can instantly understand what is damage. All that customers need to do is upload pictures of the damaged site.

Promotes efficient underwriting

Pricing the risk correctly is crucial for insurers. Every year, insurers report a loss of billions of dollars on account of underwriting losses.

API integrations can go a long way in improving underwriting models and help insurers become more agile and efficient. They can retrieve data straight from the source in real-time, to make sure that your underwriting model takes into account complete and up-to-date information. Automation allows helps to reduce the time spent in sorting, extracting, and analyzing large data sets.

Such integration can be particularly useful for medical insurance where APIs can retrieve data from patient portals, lab reports, pharmacies, and electronic health records maintained by primary healthcare providers. This can save precious hours spent on repetitive manual processes looking for missing information and feeding them into complicated spreadsheets.

Usher into the era of digital transformation using insurance APIs

If digitalization is on your agenda, now is the time to partner up with an enterprise platform such as CoverGo. With CoverGo, it’s a cakewalk to accelerate digital transformation as you get access to an award-winning no-code product builder that helps you to create multiple insurance products in under a few hours, without a single line of code, and make them instantly available through CoverGo’s open insurance APIs.

You can add new components as you grow and accelerate the time to market your products, gaining an edge over your competition. You can fully adapt and configure everything to your exact needs and business complexity, futureproofing your business.

Schedule a demo with CoverGo to gain a true partner for your digital transformation.