Our flexible solution, your future-proof transformation.

We empower insurance professionals like you with flexibility across the entire value chain and process. As the industry evolves rapidly, navigating solutions for your complex ecosystem can be overwhelming. Let us guide you toward your future-proof transformation.

Flexible business approach

For us, flexibility translates into dynamic business outcomes—quick wins today, end-to-end improvements tomorrow, and a record speed to market and adaptability every day.

Flexible product building

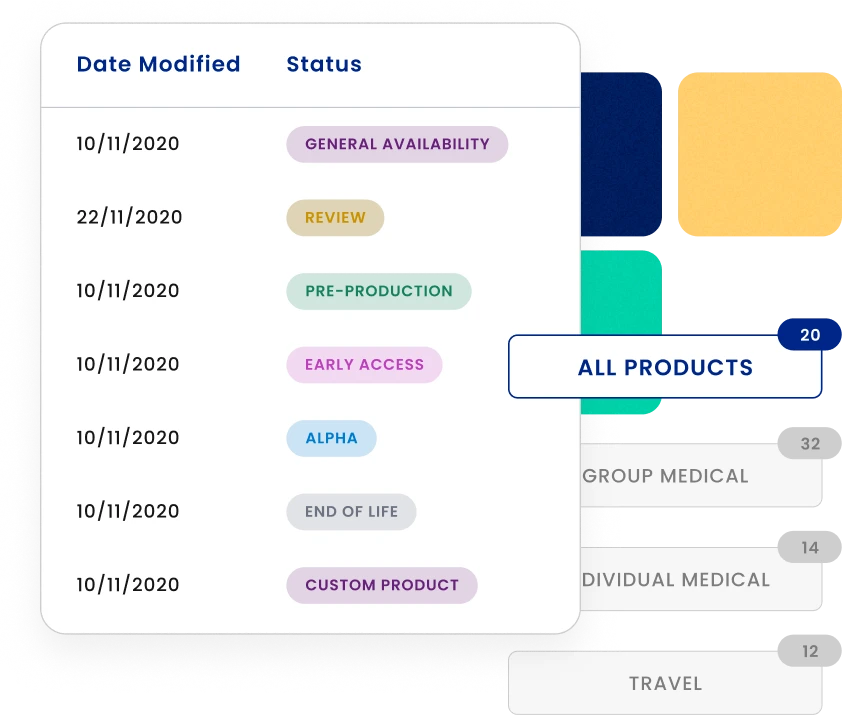

Our flexible platform enables you to build and manage your insurance products effortlessly using our patented no-code tools.

Flexible product types

Whether it’s health, life, or P&C insurance, we have a solution for your product.

Flexible architecture

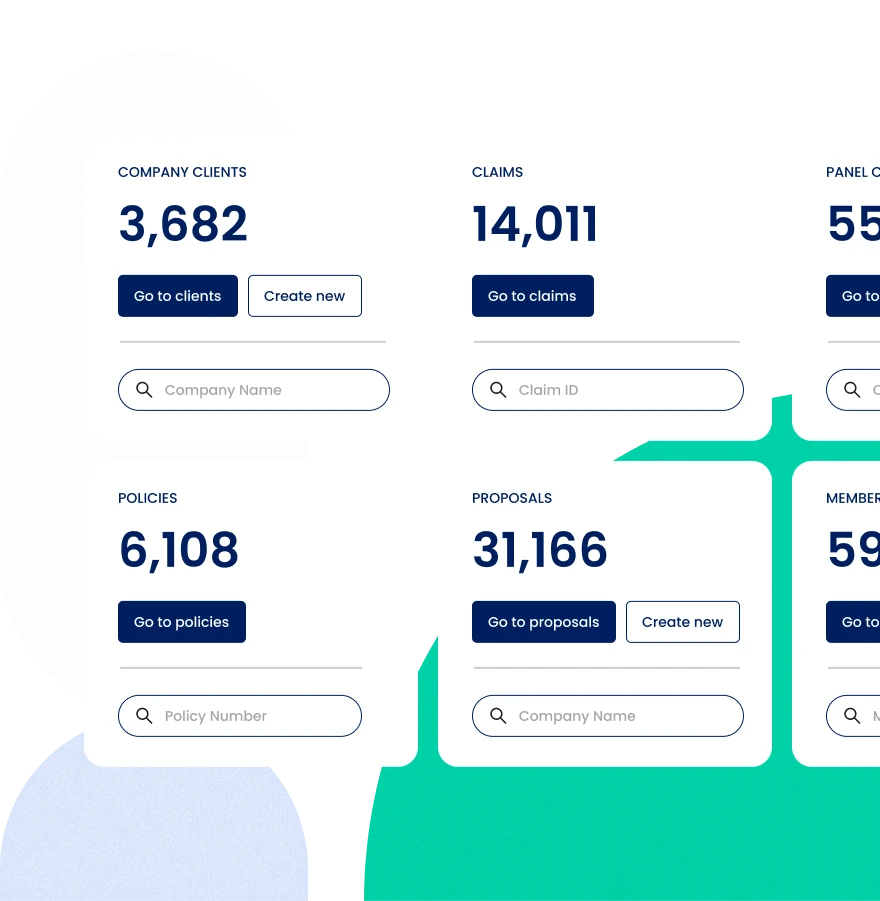

We bring modularity to the forefront. Utilize the CoverGo platform in parts or in full, implement select modules, or opt for end-to-end digitization.

Flexible innovation

Flexibility, to us, means continuous innovation. Our regular system updates ensure you always have the most innovative platform, not just today or tomorrow, but in the next decade.

Flexible distribution

We offer flexible distribution channels. Choose from omnichannel or single-channel distribution—embedded insurance, affinity partnerships, broker or agent distribution, and bancassurance channels—all tailored to meet your specific needs.

Flexible adoption

We offer flexible adoption — adopt CoverGo in parts or in full, as a digital layer on top of your existing system, as a core replacement, or as a greenfield platform.

Flexible deployment

Our approach extends to flexible deployment, accommodating whatever cloud you have and wherever you operate jurisdiction-wise.

Flexible delivery

Through our agile process, flexibility also encompasses delivery. Insurers love CoverGo’s business-first series of MVP implementation approach as it enables them to experience tangible benefits and monetize the solution much faster.

With CoverGo, you're not just staying ahead in the game

You're getting the business results you need and keeping your customers happy at every step of their journey with you.

Say goodbye to...

Launching products in 12 months

High IT maintenance costs

High customer acquisition costs

Getting locked into your vendors

Transformation projects that never end

Expensive tailor-made portals

...Say hello to

Launching products in 1 week

Reduced maintenance overhead

Reaching new customers on digital channels

Vendor flexibility and better terms

Modular adoption to enable quick wins

Pre-built white-label portals

Trusted by leading insurance companies globally

Adopting CoverGo generates significant economic impact for insurers

increase in policy sales

cost savings on product development

cost savings on IT maintenance

reduction in claims processing times

What our clients are saying

Low-risk, future-proof SaaS business model

CoverGo’s Software as a Service business model and flexible contract terms tailor-made to your needs enables you a low risk, yet future-proof solution. No more vendor lock-in or solutions that become outdated after a year.

Modern tech for modern insurers

A cutting-edge and unique technology backbone that stands out.

Microservices architecture

Robust enterprise microservices architecture to maximize scalability and flexibility.

No-code

Patented insurance product builder and configuration tools empowering business users.

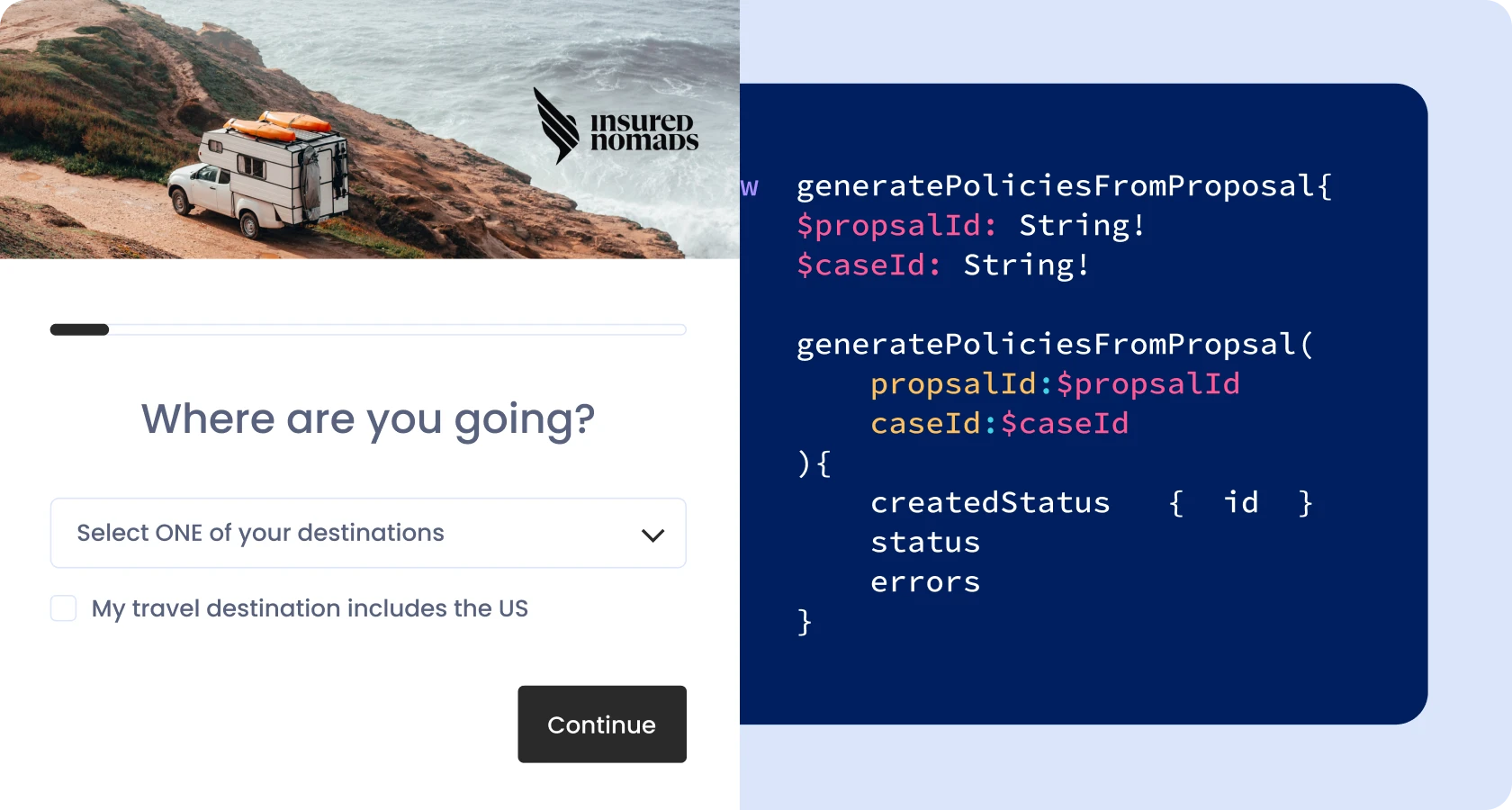

Open insurance APIs

Easy integrations with any legacy and third-party systems to enable seamless ecosystem and processing.

AI-ready

Enabling AI capabilities through integrations with novel models and AI applications.

Multi-cloud

Enterprise-grade infrastructure deployed on any cloud and jurisdiction for full regulatory compliance globally.

Automated upgrades

New product features and upgrades are released continuously. The CoverGo you buy today will be even better tomorrow.

Bank-grade security

ISO 27001 certified with the highest standards of data security and bank-grade encryption throughout.

99.9% uptime

CoverGo commits to 99.9% uptime and 24/7 support for our clients globally.

And ultimately, it's about our people

Driven by a team of passionate insurance and tech professionals who speak the language of insurance, we’re committed to going above and beyond to support your digital transformation journey. With over 500 years of collective experience in insurtech and insurance enterprise software, our experts are dedicated to serving as your trusted technology partner.

Recommended resources

Discover how insurers are driving growth with CoverGo